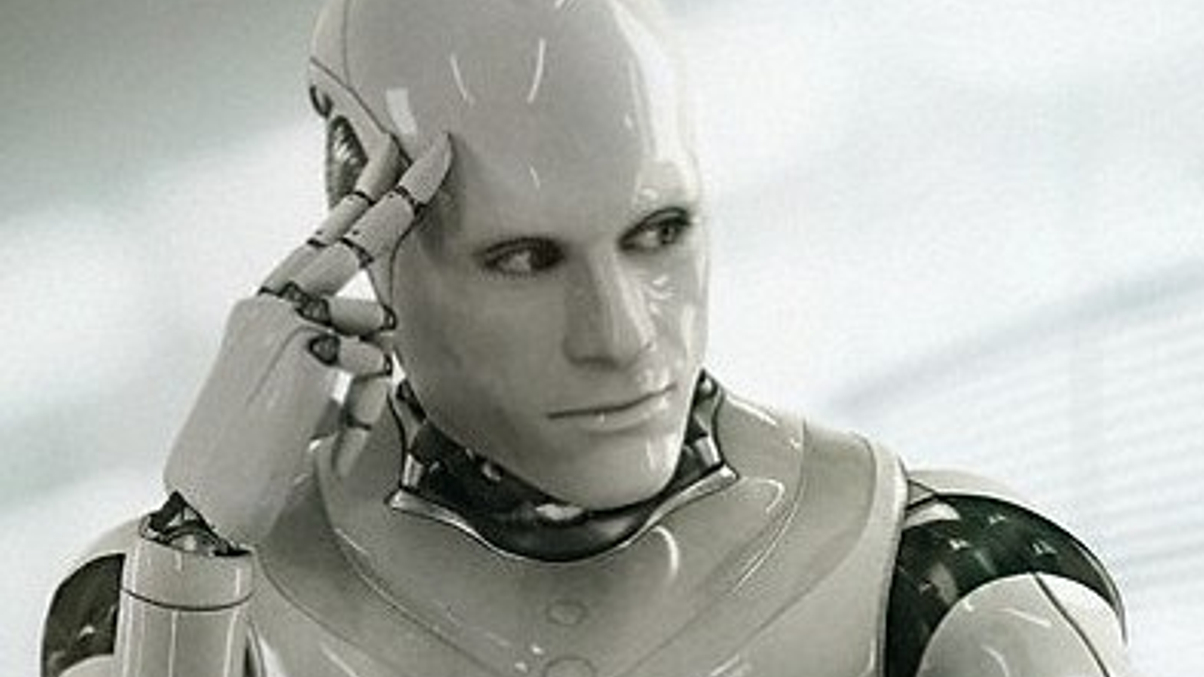

Opinion: Seeking ethical android advisers

The scandal surrounding Australia’s financial services company AMP and poor satisfaction levels suggest robo-advisers may have a big opportunity.

Asia Pacific’s fund industry is facing a crisis of confidence.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.