HK crisis may be a wake-up call for city’s PE plans

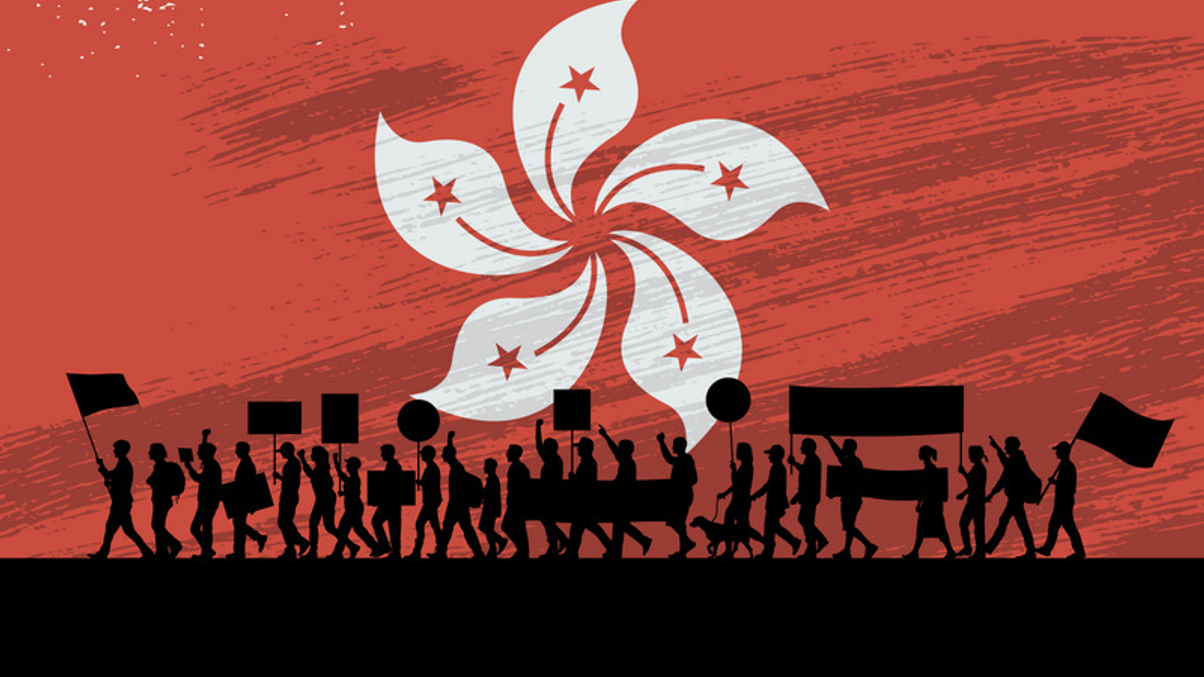

Hong Kong may struggle to become Asia’s private equity hub despite tax incentives thanks to the city's deep-rooted issues, suggest investment industry executives.

Hong Kong may have ambitions to supplant Singapore as Asia’s private equity hub but it faces bigger challenges than the Lion City that could take years to overcome – and have been made all the more pressing by its recent political troubles.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.