Weekly roundup of people news, August 13

Julius Baer names new Asia chief; StanChart hires discretionary director; La Trobe boosts distribution sales team; Axa RE IM opens Seoul office; Eversheds hires partner for PE; and White & Case moves to Korea.

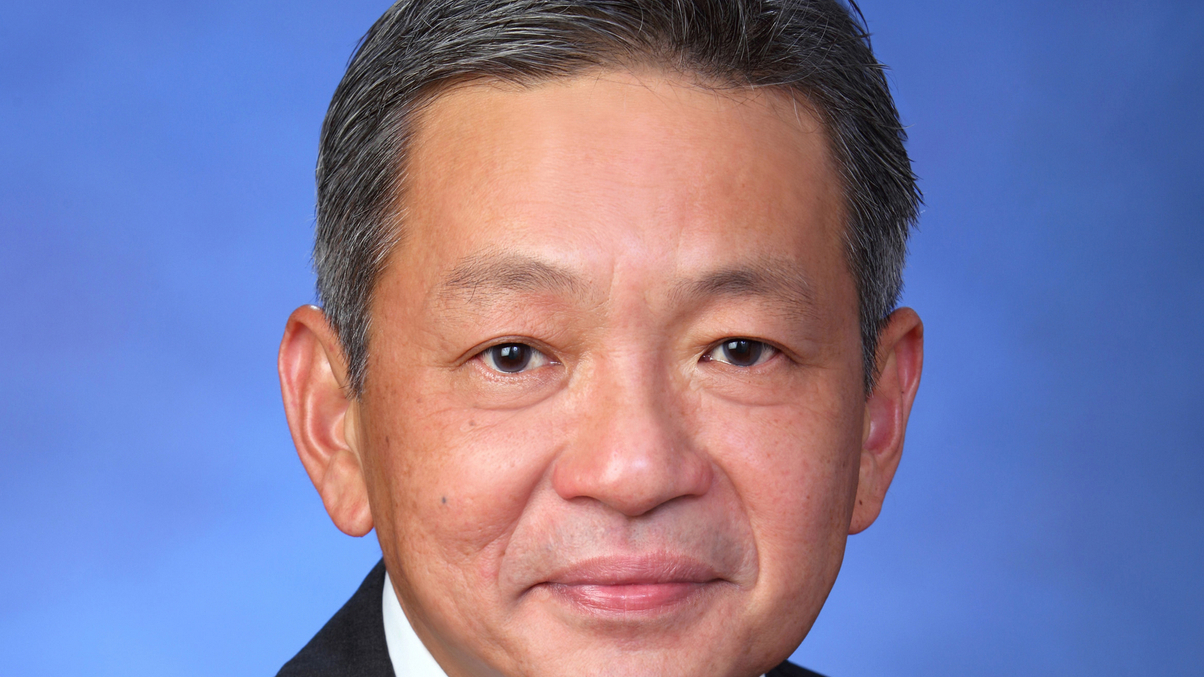

Julius Baer names new Asia-Pacific head

Swiss private bank Julius Baer has hired Jimmy Lee to be its new Asia-Pacific head.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.