Risk-on Chinese investors at mercy of market volatility

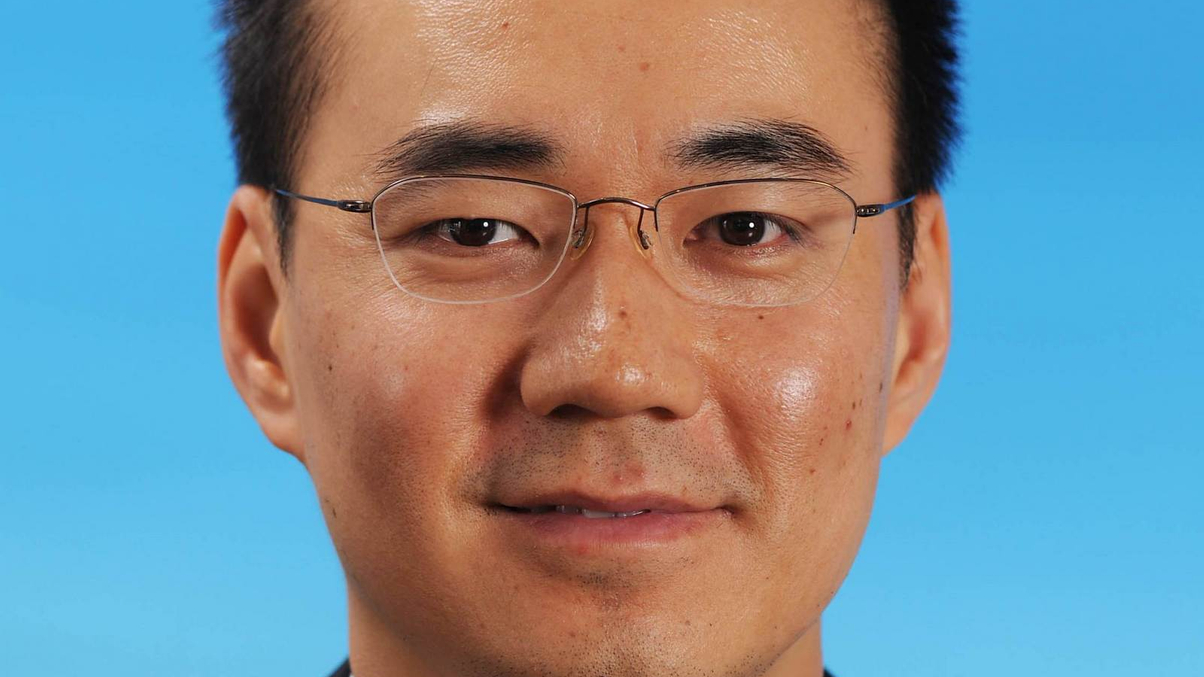

The recent stock market slide in China can be considered a cautionary tale for investors taking on too much risk, says Manulife’s chief equity investment officer for Asia.

Investors in China take the most risk in the region, while Japanese investors are the most risk-averse, according to a newly-released Asian survey.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.