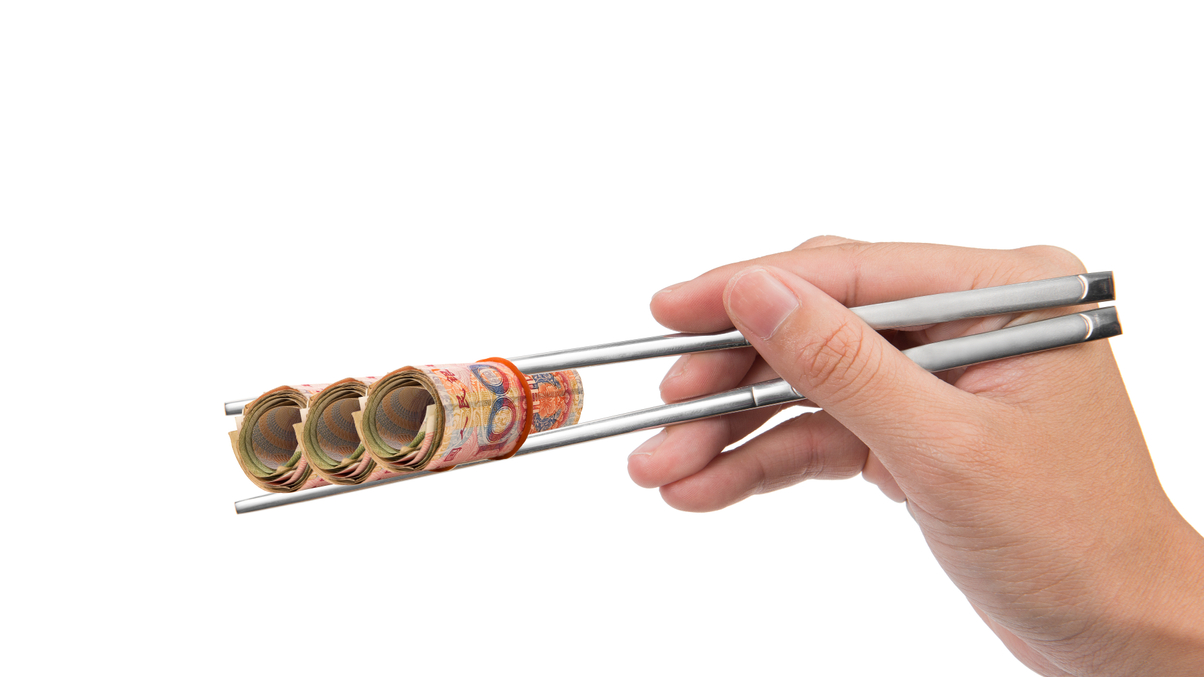

How China insurers aim to fill a growing PE hunger

More Chinese insurers are expanding their teams for private equity investments as interest in the asset class grows. They are still likely to have to rely on external managers though.

Chinese insurers are increasingly building out their in-house expertise on private equity investments but most will probably continue to rely on external managers.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.