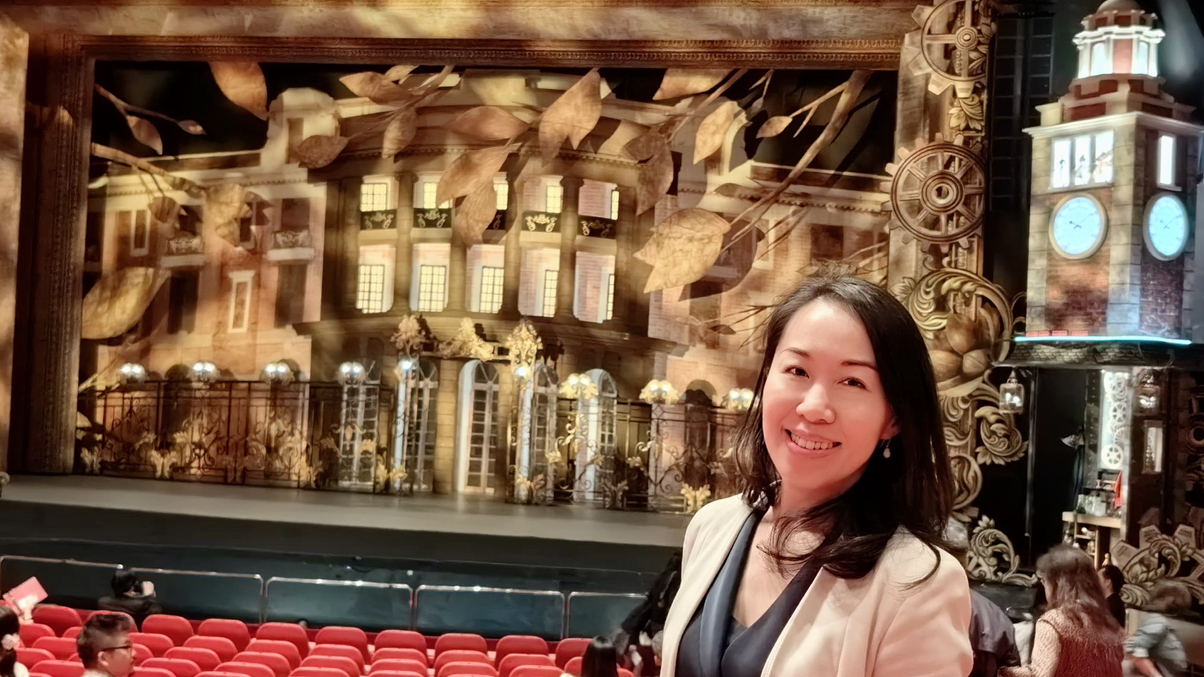

Editorial Board Spotlight: Candid Q&A with Carol Mo

CTF Life's deputy chief investment officer talks about her 'research-driven' hobbies, her passion for music and how she unwinds after a busy work day.

Carol Mo is the deputy chief investment officer of Chow Tai Fook Life Insurance Company (CTF Life). She joined in October 2022, after a previous stint of nearly five years until May 2020.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.