China's premier pledges private banking expansion

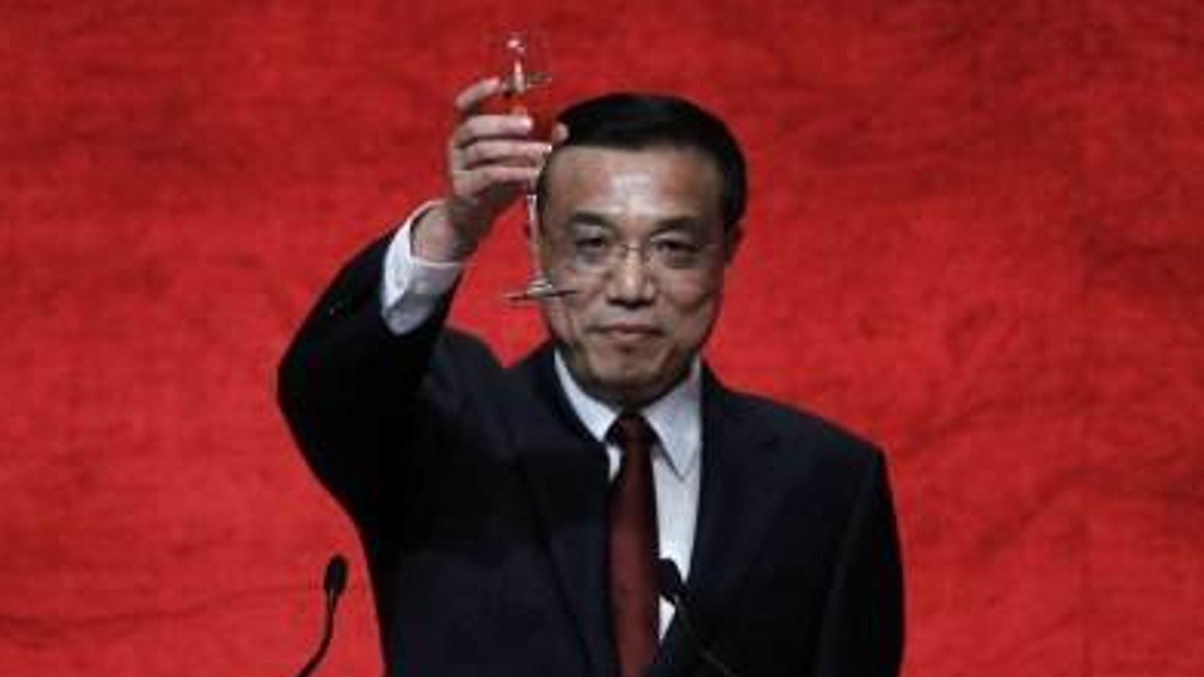

Li Keqiang has called for more private banking licences to be issued, in a speech to the National People's Congress. He also made promising references to the launch of Shenzhen-Hong Kong Stock Connect.

China’s premier has called for more private banking licences to be issued in a bid to boost the market and move forward his liberalisation campaign.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.