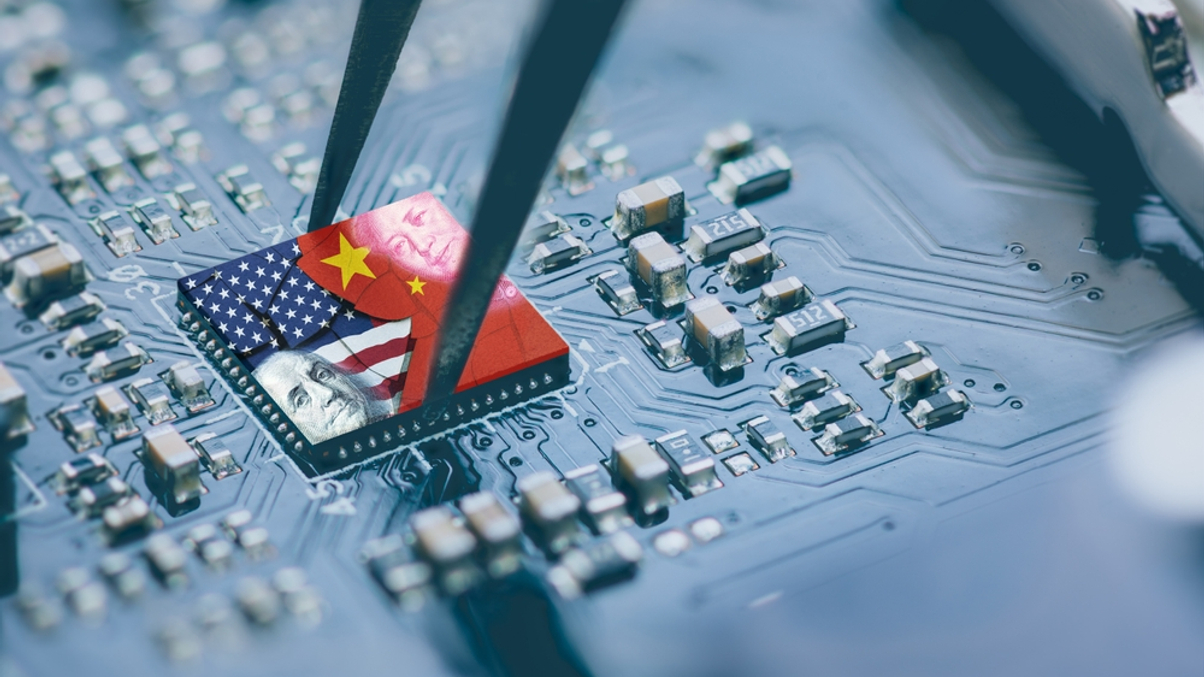

Biden's China tech ban to benefit non-US PE investors

Non-US investors could potentially gain from the Biden administration's recent ban on investments in Chinese tech companies, as they replace US funding and propel domestic tech development.

The recent US ban on certain investments in Chinese tech companies presents potential private equity opportunities for investors to fill vacated US funding, industry players said.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.