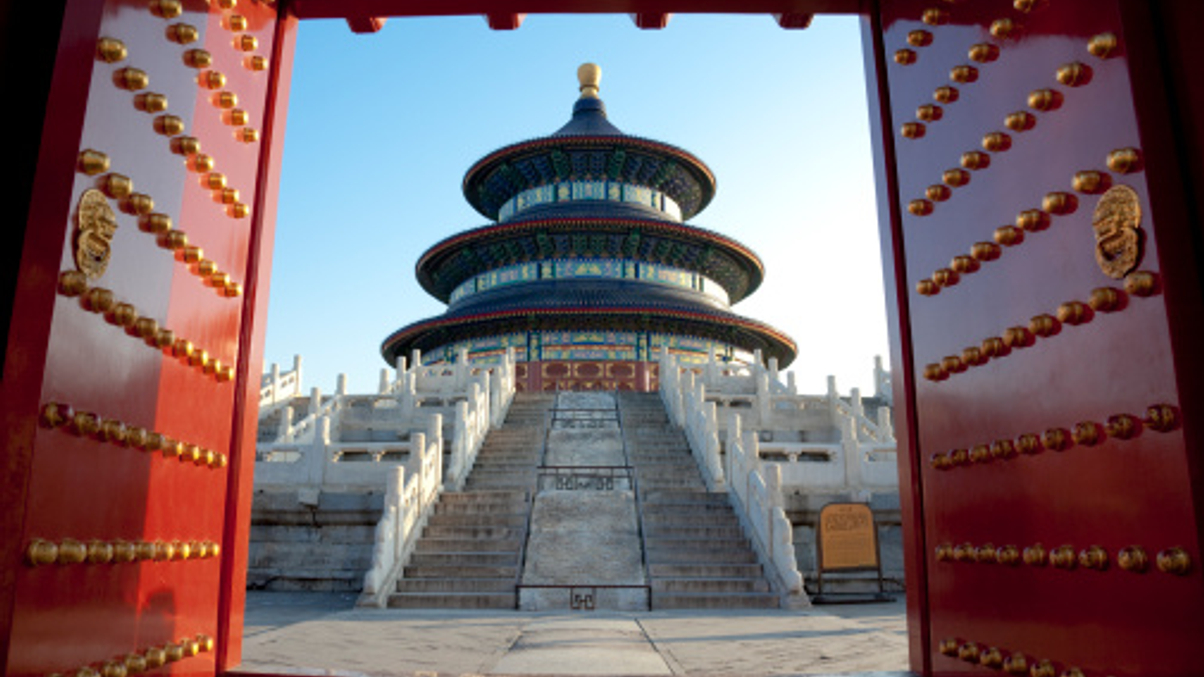

LGT Capital launches flagship China office

The Switzerland-based alts asset manager launches its first mainland operation in Beijing, as it examines potential primary, secondary and co-investment deals in China.

LGT Capital Partners, the Switzerland-based alternative asset manager overseeing $25 billion, has launched a Beijing office, marking its first operation on the mainland.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.