Why EPF shuns hedge funds and smart beta

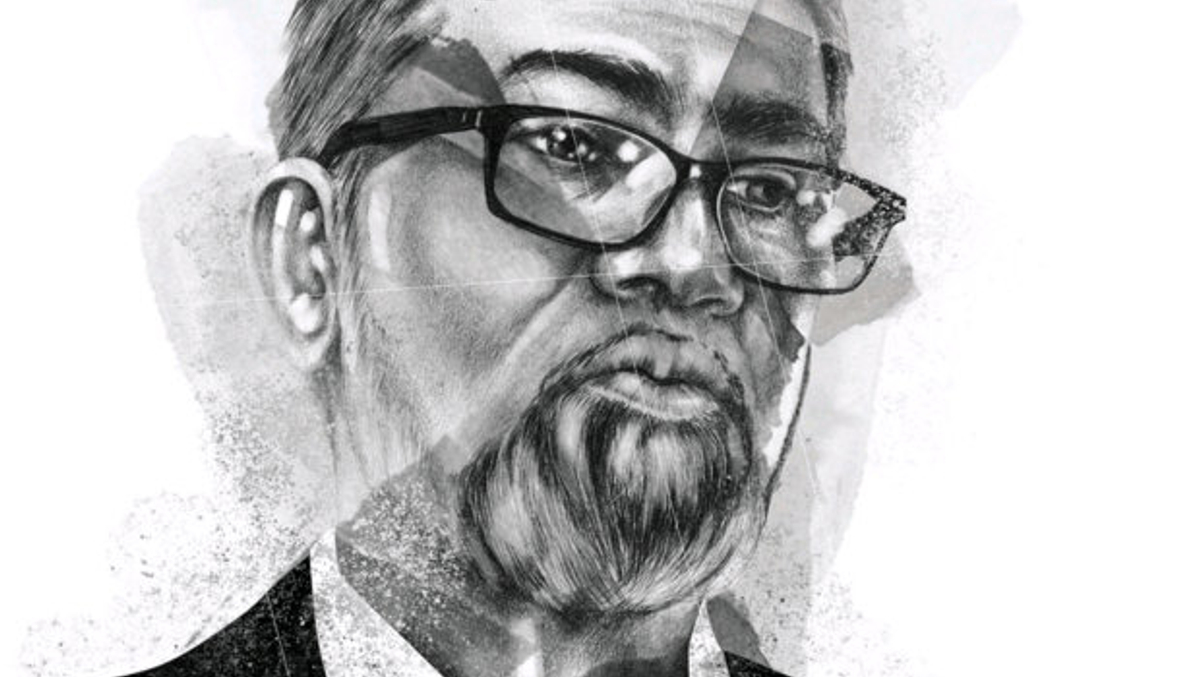

The deputy chief executive of Malaysia’s biggest state retirement fund tells AsianInvestor about its investment approach and where it sees opportunities.

Like other institutional investors. Malaysia’s $161 billion Employees Provident Fund is exploring how it can maintain above-target returns in the current low-yield environment. Two things it does not use, however, are hedge funds and so-called ‘smart beta’ strategies.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.