Why Asian asset owners are leery of volatility derivatives

Asset owners say there are several reasons behind their reluctance to invest into volatility index futures. They explained to AsianInvestor what they were.

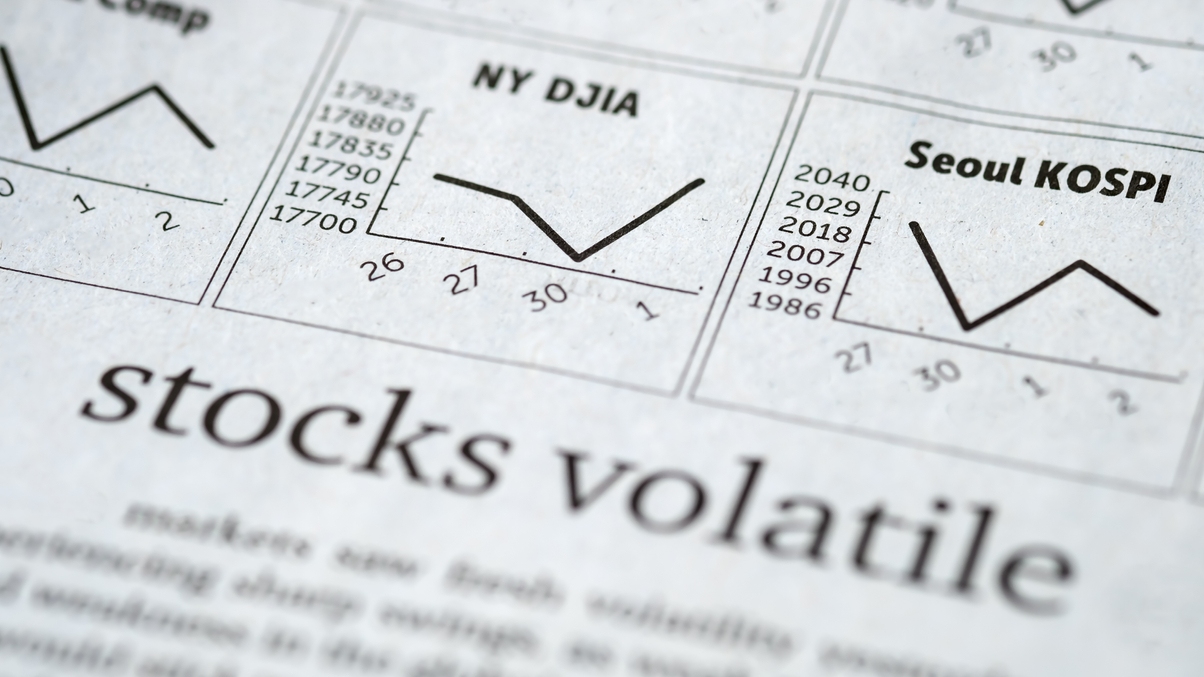

Despite the rise in market volatility in Asia and other markets, the use of volatility index (Vix) futures has yet to attract much investment from regional institutional investors.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.