Weekly roundup of job-hoppers, Oct 5

Eastspring adds Korea CEO, Johnson quits UBS, Pictet and BNPP IP make EM debt hires, Coutts names Asia NRI head and Reliance Capital shuffles in credit management.

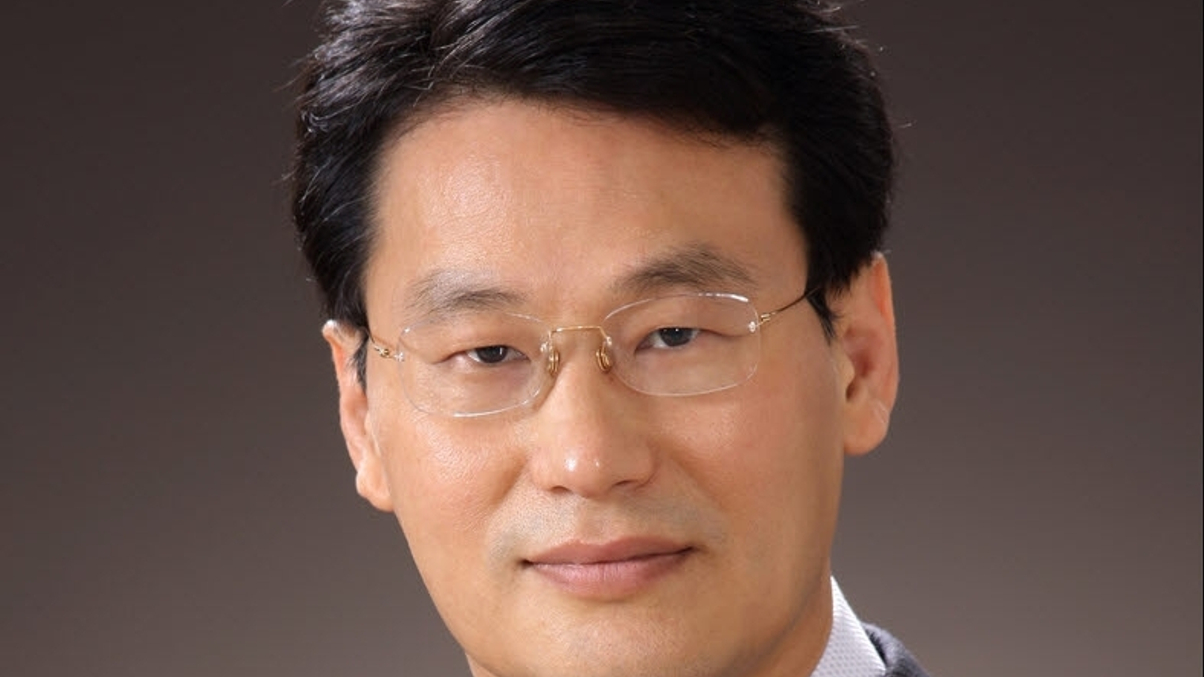

Former Mirae chief resurfaces at Eastspring

Prudential-owned Eastspring Investments announced the appointment of Woong Park as chief executive of the group’s Korean asset management business.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.