'Too big to fail' label threatens Asia fund markets

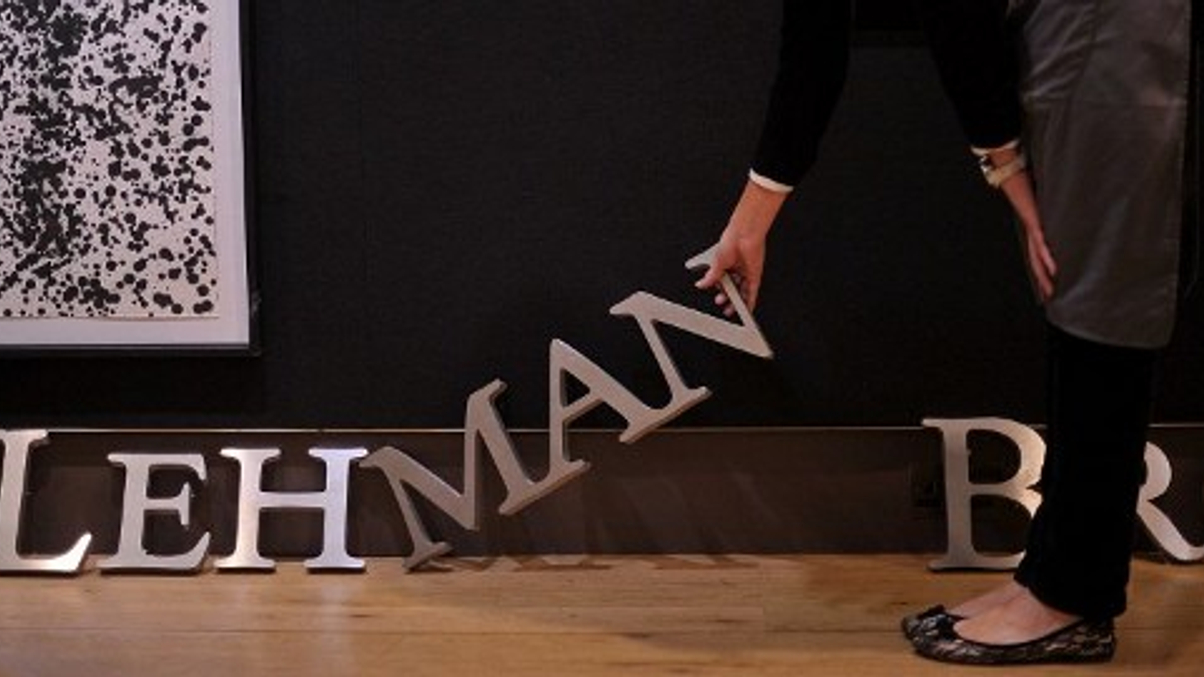

An American financial watchdog has been warned that classifying US asset managers as 'systemically important financial institutions' could seriously impair the growth of Asia's funds industry.

Applying a 'too big to fail' designation to major US fund groups would risk seriously affecting their operations in Asia, regulators have been warned.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.