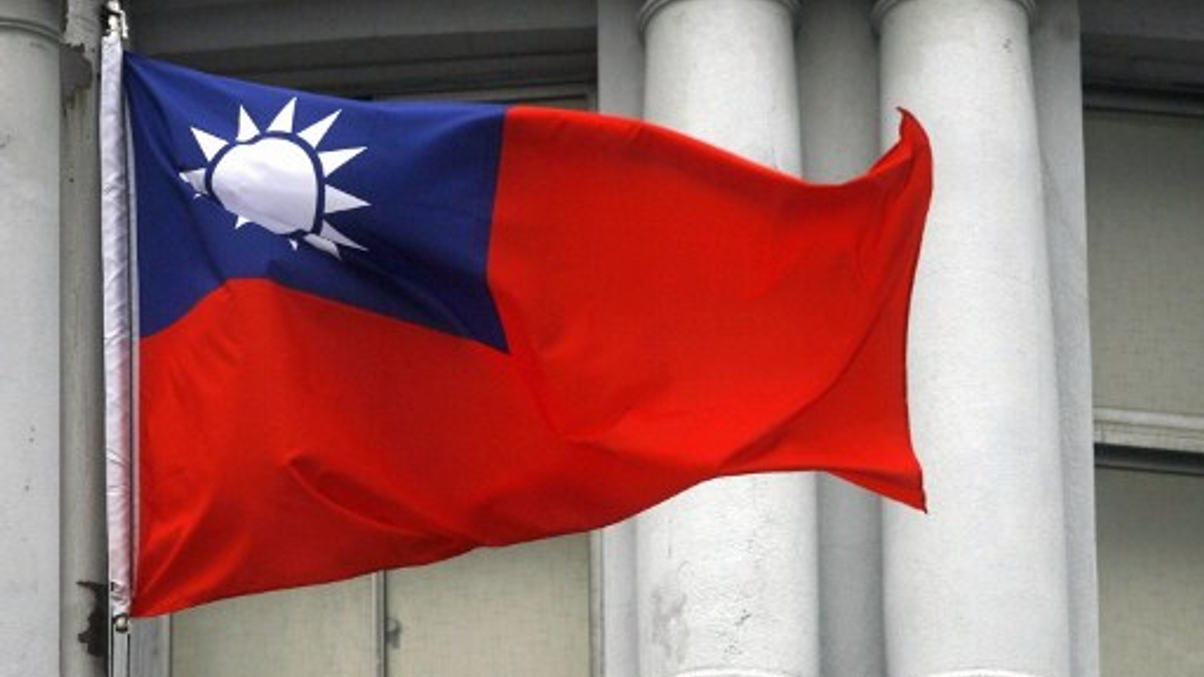

Taiwan fund industry grows 9% to $177 billion in 2021: Morningstar

Taiwanese equity technology funds draw new capital for the seventh quarter as investors turn selective on fixed income funds.

The Taiwanese fund industry recorded 9% growth in 2021, after a fourth quarter of net inflows reversed the net outflow of the previous quarter. Allocation funds led the inflows, with Taiwanese tech funds in particular leading flows into equity funds.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.