SSgA’s Asia chief reveals RQFII plans

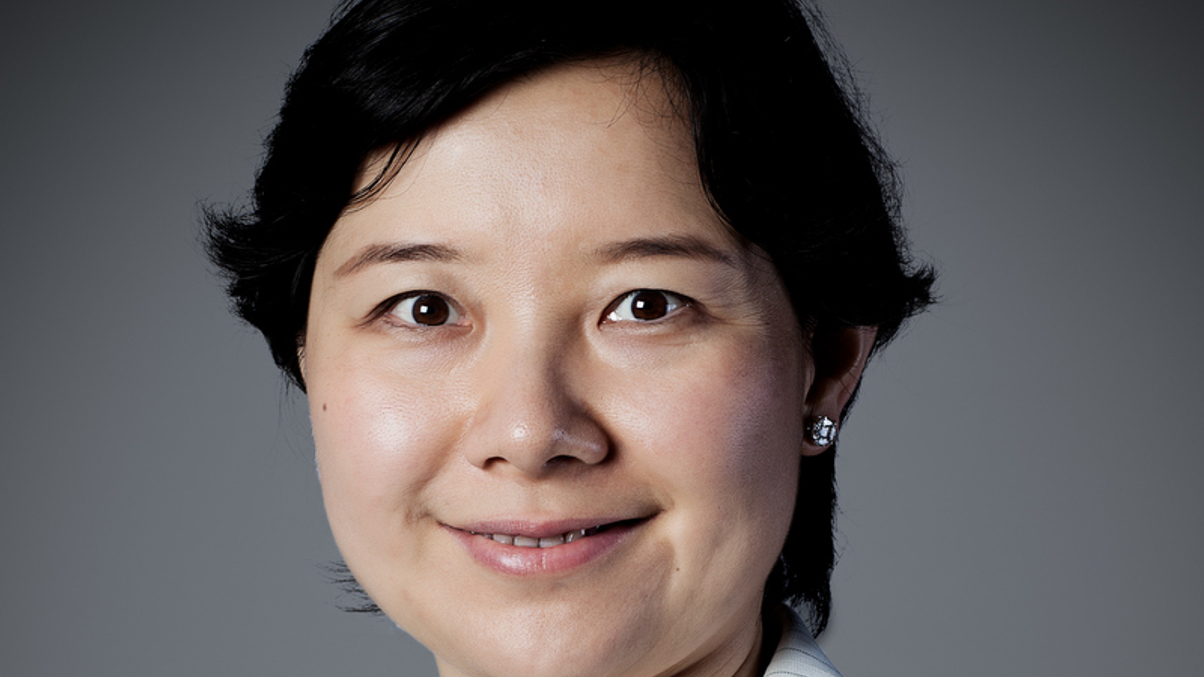

The firm's Asia ex-Japan head, Li Ting, plans to list an RQFII ETF in Hong Kong this year, and potentially also on other exchanges. This comes after it received an RQFII licence.

State Street Global Advisors’ Asia ex-Japan head, Li Ting, has spoken of the firm’s plans to list an RQFII exchange-traded fund in Hong Kong and potentially also on other overseas bourses this year.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.