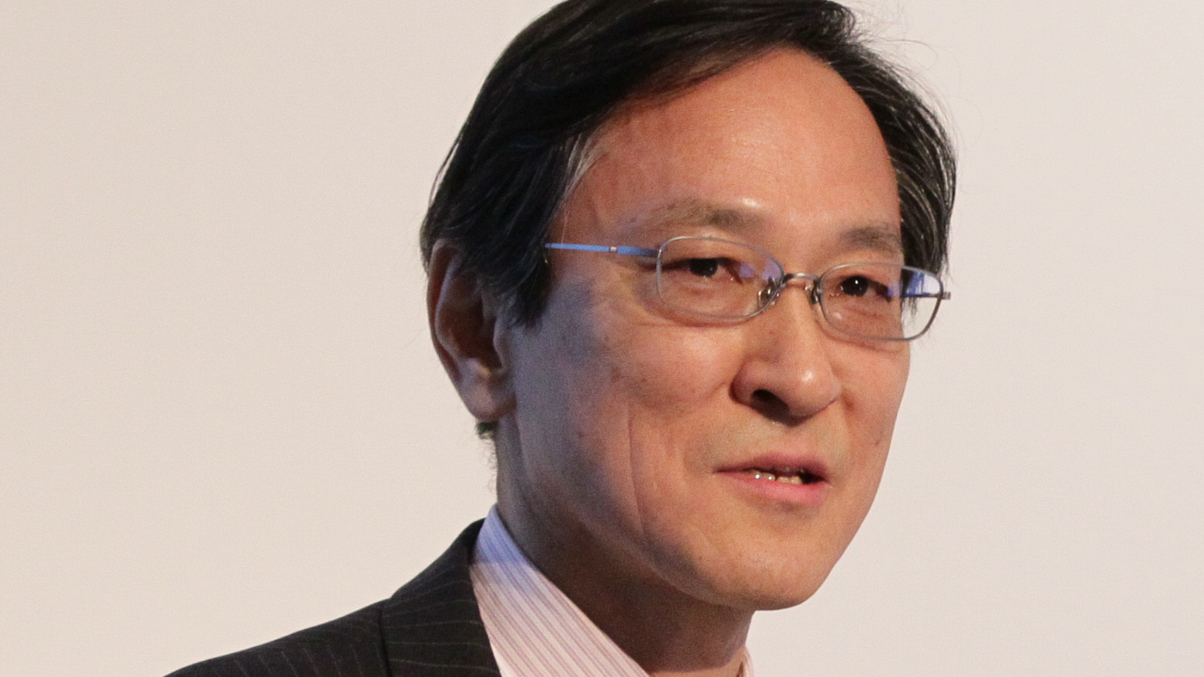

PFA's Hamaguchi sets out risk, alts strategy

Daisuke Hamaguchi, CIO at Japan's $106 billion Pension Fund Association, tells AsianInvestor how risk management has played a role in its asset allocation and what its alternatives plans are.

Japan’s Pension Fund Association (PFA) was set up in 1967 and came into being in its current guise in 2005.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.