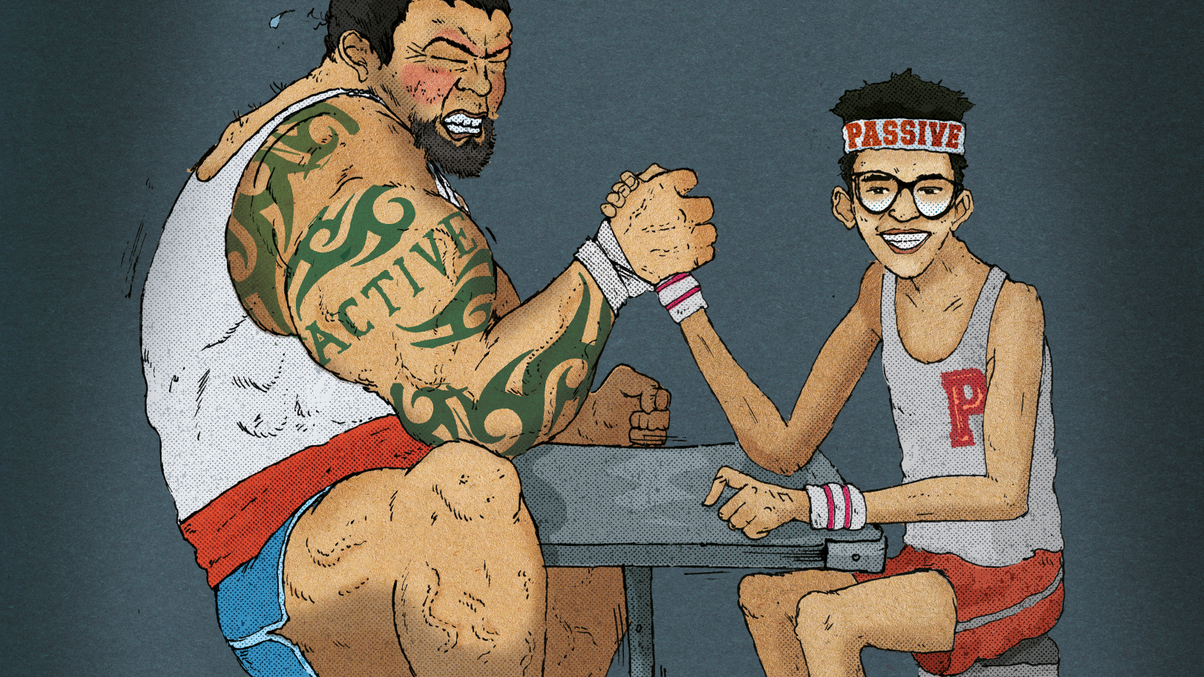

Passive funds on the front foot in Asia

With actively managed funds falling woefully short of their targets, passive products have the chance to finally overcome the reticence of Asian investors. Regulatory changes could help.

On July 1 Hong Kong’s exchange-traded funds market experienced the ‘Vanguard Effect’. Ironically, BlackRock initiated it. The world’s largest fund manager and provider of exchange-traded funds heavily slashed the fees on two of its ETFs listed in the city, in an apparent attempt to attract more investors.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.