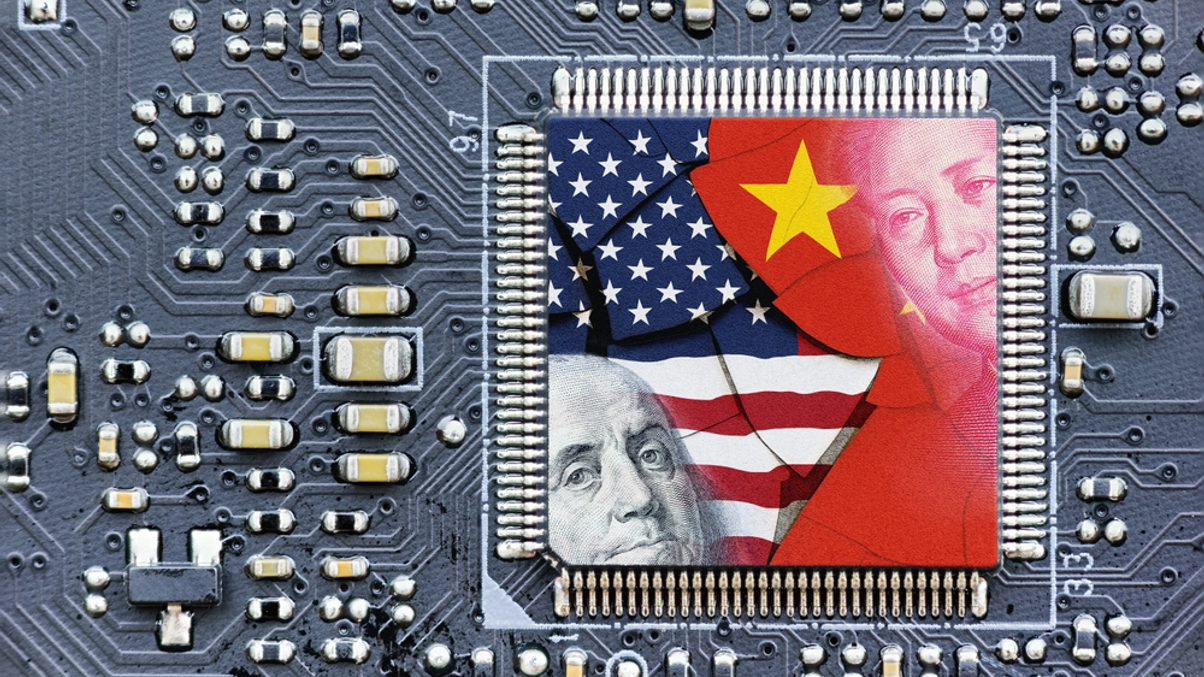

Ontario Teachers' favours US over China for tech investing

The $183-billion Canadian pension fund continues to place its main focus on the world’s leading technology market.

A senior executive at Teachers’ Venture Growth (TVG), the venture arm of $183-billion Canadian pension fund Ontario Teachers’ Pension Plan (OTPP), has affirmed the primacy of the US over China when it comes to technology investment opportunities.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.