Oil weathering storm but still faces long-term shortages

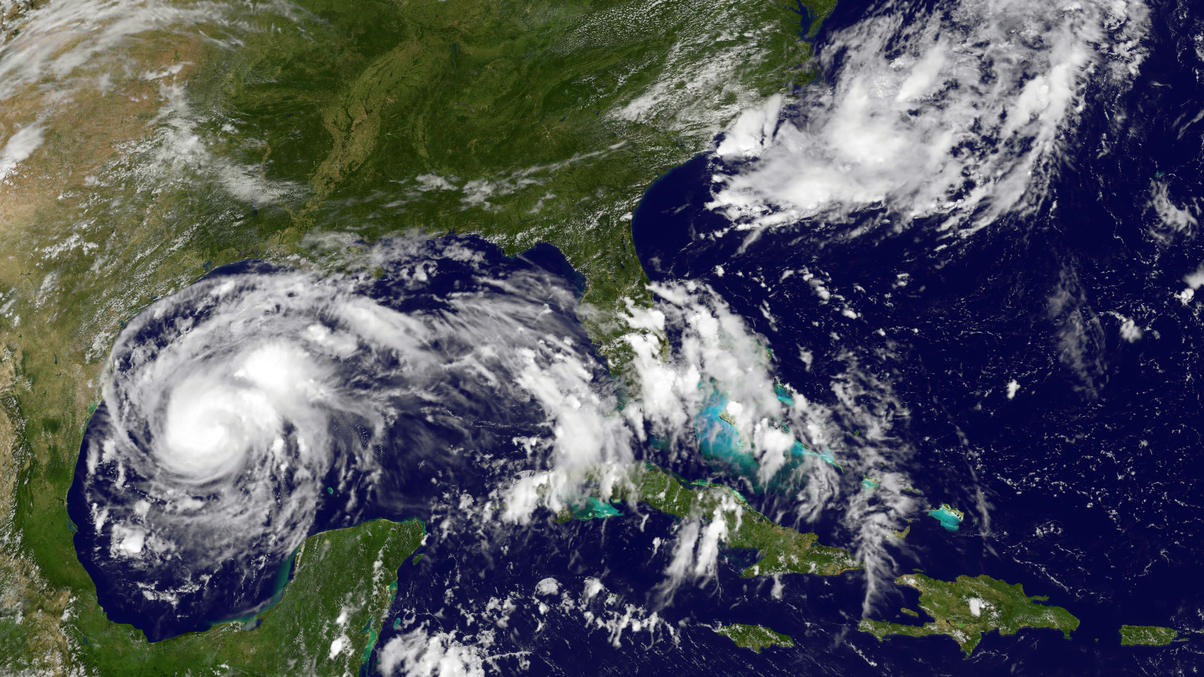

The impact of Hurricane Harvey on energy commodities is seen as limited, but more weather disruptions are likely, and investors expect long-term oil price gains.

While they believe the impact of Hurricane Harvey on energy commodities will be limited to the coming weeks, investors are predicting long-term gains in the oil price.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.