partner content

New RFQ protocols make APAC credit trading more efficient

Audio available

Reverting to voice trading in times of crisis will mean credit traders miss out on key benefits of electronic protocols.

Electronic trading protocols have gained widespread acceptance in global credit markets, proving to be resilient sources of liquidity as they cater to specific regional dynamics and requirements. However, old habits can be hard to change. It’s not unusual for credit traders to seek safety in more traditional execution protocols when volatility spikes. Old-fashioned voice trading remains a go-to choice for tougher transactions on the best of days, and a fallback for some when market conditions turn sour.

This has been prevalent in Asia, where voice trading has reasserted its dominant grip over the local credit market in the wake of the 2021 China real estate crisis.

The hesitancy among traders was well founded. Market dislocations from the crisis in Asia credit were, after all, severe. Daily trading volume fell from about $58 billion in March 2020 to $15 billion in December 2023, recovering only slightly since then. Meanwhile, new issuance plunged to levels 40% to 50% below its high point of $610 billion in 2020/2021. Sourcing liquidity with tight bid/offer spreads was suddenly excessively challenging for those still active in the markets. (Source: ICMA’s ‘The Asian International Bond Markets: Development and Trends Fourth Edition, March 2024’).

As a result, in searching for comfort, insight and discretion, Asia’s buyside reverted mostly to the time-honoured way of trading bonds, believing a phone call or message to still be the best methods for doing a deal.

Yet by pivoting away from electronic protocols, these traders are missing out on liquidity, innovations and pricing practices that could dramatically change how they source real interest, match bids/offers to dealers and improve execution pricing.

Creating a path to liquidity

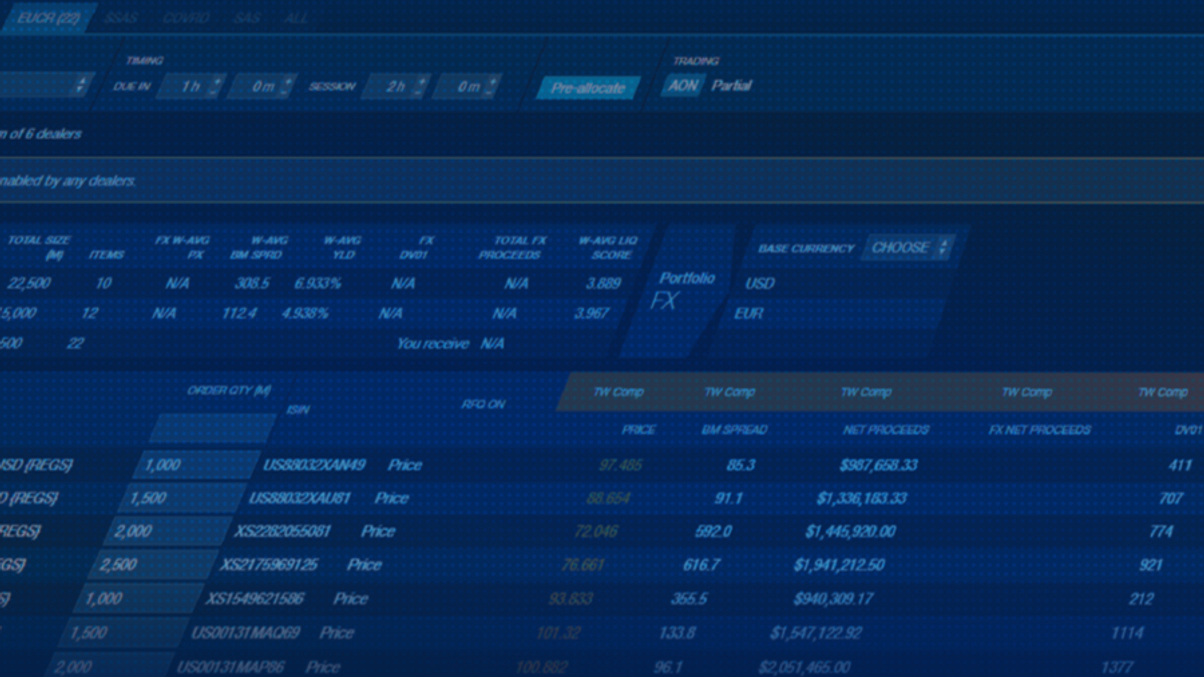

Among these electronic protocols is Tradeweb’s SNAP IOI, which automatically selects dealers for trades based on untraded positions from Tradeweb’s interdealer matching sessions (or auctions), Sweep. Unlike all-to-all blasts, which broadcast positions far and wide, SNAP IOI funnels quality dealers to the trade, rather than just a large quantity. This helps to minimise the information footprint of the transaction while ensuring best execution.

More specifically, when a trader submits an order through the Request-for-Quote (RFQ) protocol, and then selects the SNAP button to select dealers, SNAP gets going behind the scenes. It checks if any dealers have outstanding positions from the daily auction in the requested bond and in the direction the trader wants to trade. It then selects only those dealers whose positions are equal to or greater than the order in the RFQ. The trader has the ability and control to manually change this list of dealers, or choose other dealers, should they decide to.

This process delivers some key benefits to the buyside trader, namely:

- Access to a unique pool of inter-dealer liquidity

- Discovery of the best dealer axes and prices

- Control of information by only targeting motivated counterparties

- Customisation of a preferred dealer list

Since SNAP IOI’s inception in the Asian credit landscape, the protocol has achieved superior transaction cost analysis compared with other dealer selection methods. It taps liquidity from Tradeweb’s interdealer Sweep auction, where more than $1.5 billion of notional volume across 1,000+ ISINs is submitted daily (Source: Tradeweb, November 2024). Any unmatched interest from these daily auctions then becomes available as axes through the SNAP IOI functionality.

Channeling liquidity to a barren Asia credit market

As liquidity in Asia credit has thinned out over the past few years, finding dealers interested in a given trade has become increasingly challenging. In response, the buyside has doubled down on familiar dealer ties, hoping for an edge in information and relationship support for trades.

In doing so, traders have eschewed other avenues to liquidity, compounding the structural issues already present in the market. By contrast, those who have explored protocols like SNAP IOI have discovered unexpected opportunities with dealers they don’t often use, or have never considered using. These dealers were already primed to trade, since they’d posted their positions through the interdealer Sweep auction. When it was time to execute the trade, buyside users often picked a dealer that they didn’t normally use.

It’s still early days for SNAP IOI in Asia. The experience in European credit offers an interesting benchmark – based on over Eur26 billion ($27 billion) notional in submitted orders made up of between 8,000 and 9,000 ISINs (source: Tradeweb data, January 2025). If used as a guide, we believe the protocol can support Asia’s credit markets by creating more transparency and liquidity in a wider range of bonds.

Safety and certainty of execution in tough markets can be a scarce and valuable commodity for buyside traders. Indeed, it’s not surprising to fall back on a time-tested approach with familiar dealers. But in markets around the world, electronic protocols are proving a reliable extension of liquidity, transparency and price discovery which the buyside can tap for best execution, alongside their calls to dealers.

Disclaimer:

This article is intended for the jurisdictions in which Tradeweb operates. Reach out to [email protected] to discuss whether our services are available to your organisation.

To find out more about Tradeweb’s registered entities and locations, please visit: https://www.tradeweb.com/disclosures/registered-entities-and-office-locations/

¬ Haymarket Media Limited. All rights reserved.