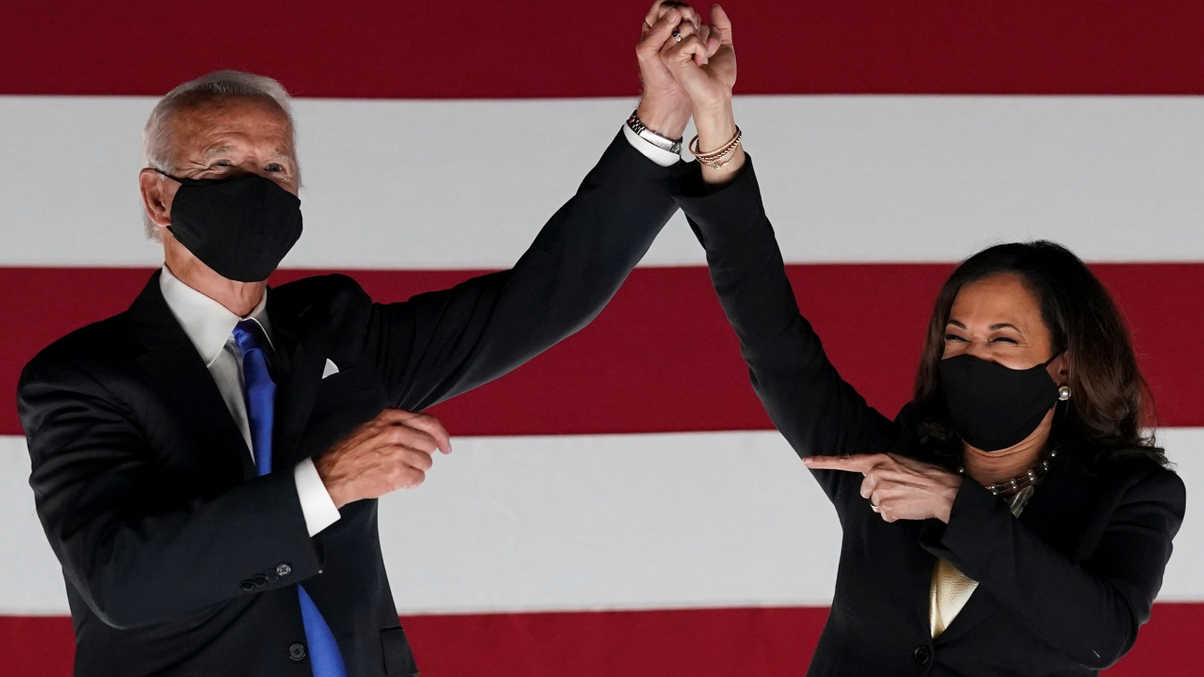

Investors react to Joe Biden’s US election win

The largest-ever turnout in a US presidential election has led Joe Biden to overthrow Donald Trump. Fund managers and other industry experts offer views on the investment implications.

LAST UPDATED: 12.01pm Hong Kong time, November 10

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.