Invesco on Asia hiring drive as new chief eyes growth

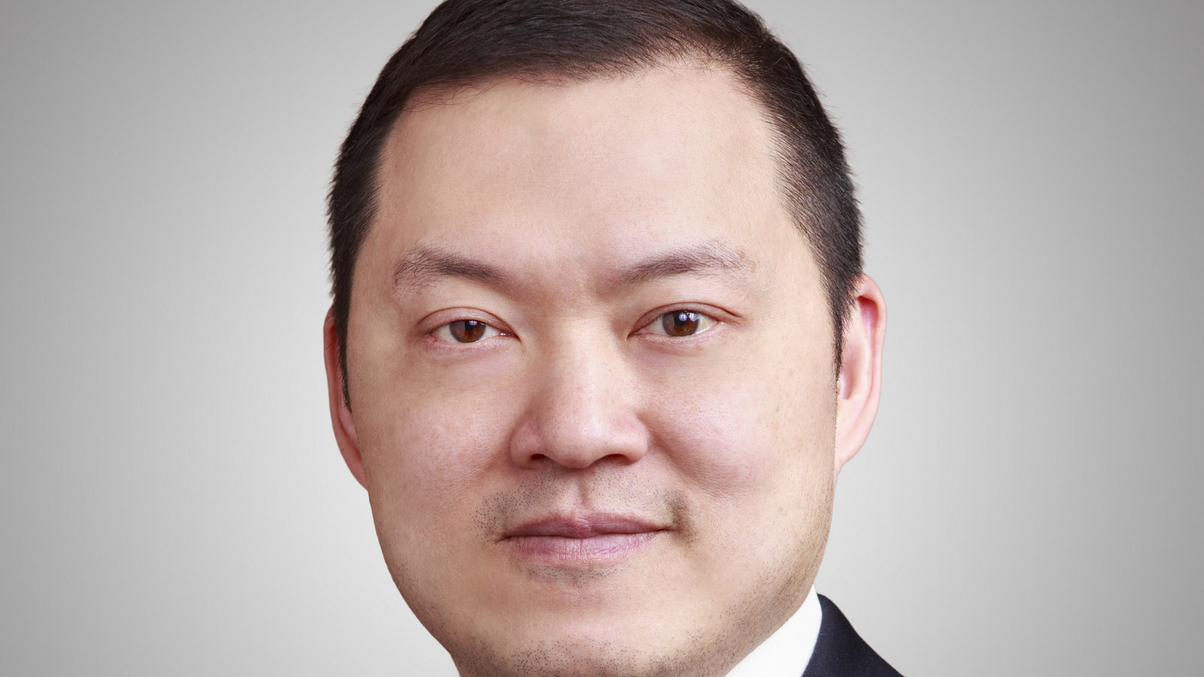

The fund house's growth plans include the hiring of dozens of staff across Asia, its CEO for China, Korea and Singapore tells AsianInvestor. Terry Pan has made Singapore expansion one of his priorities.

US fund house Invesco is on a hiring drive in Asia Pacific, with the firm looking to recruit dozens of staff across a broad spectrum of posts to fuel growth.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.