Insurers must think outside low-yield box: MAS

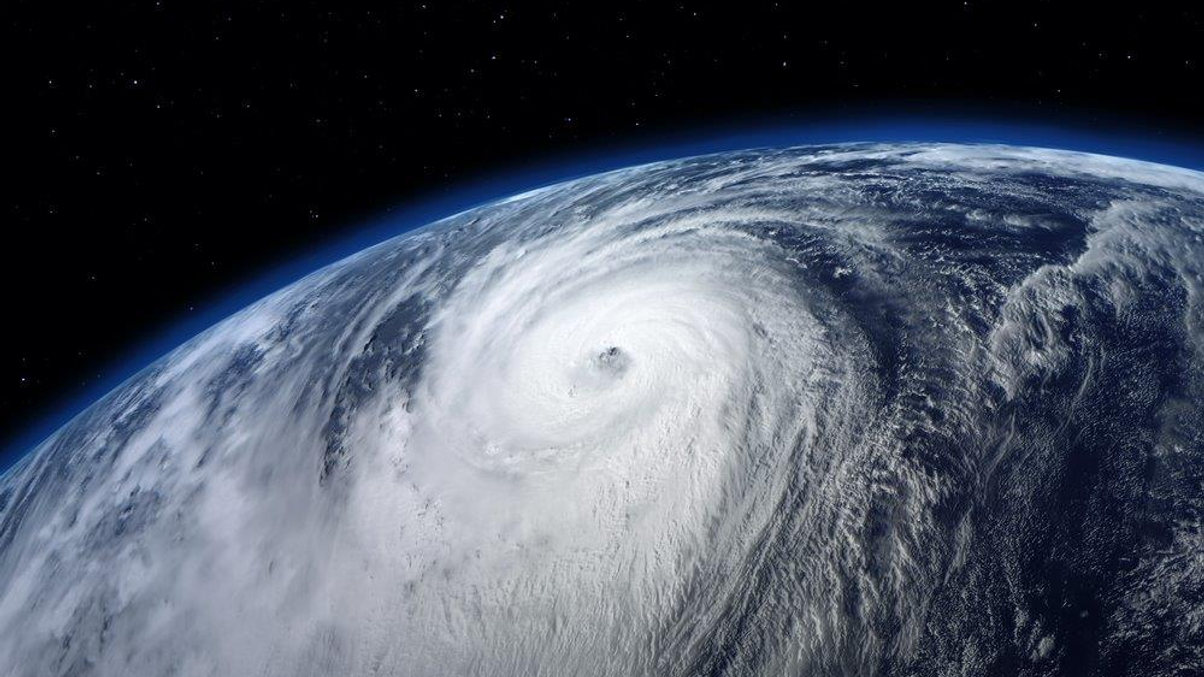

Insurers in Asia should take on risk as they face more claims amid the rising number of natural disasters, says Jacqueline Loh deputy MD at the Monetary Authority of Singapore.

Asian insurers need to think outside the low-yield box and take on greater risk across the full spectrum of asset classes, according to the Monetary Authority of Singapore.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.