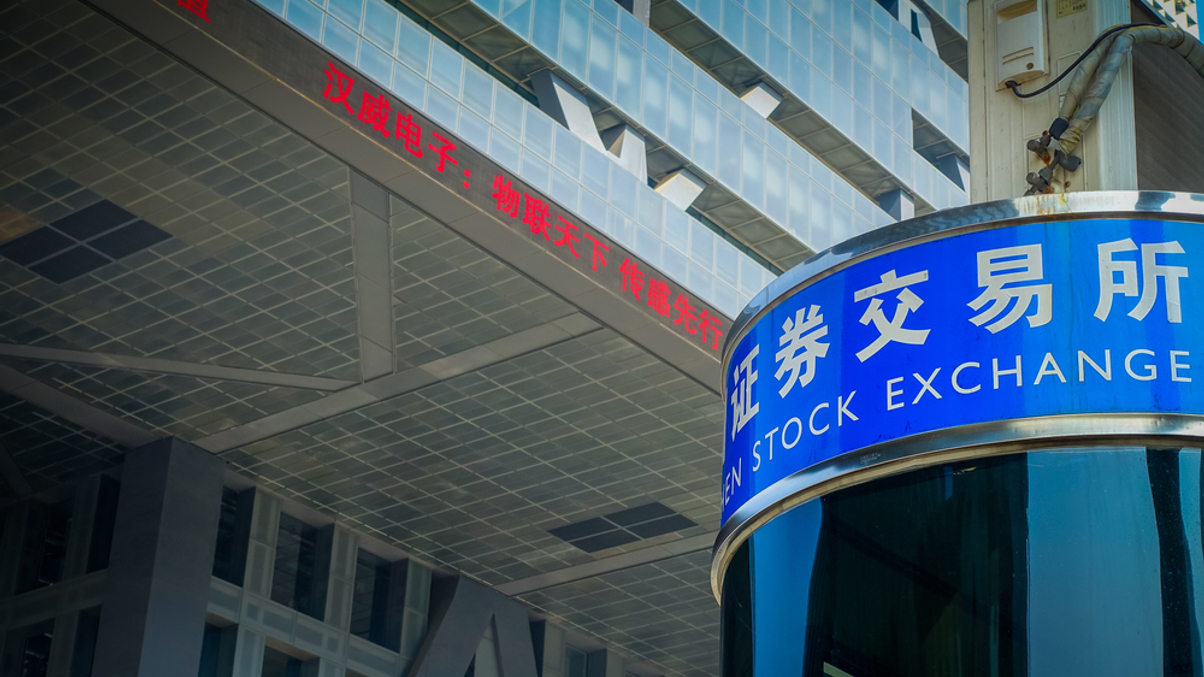

Insto roundup: Australia's Future Fund announces new investment strategy; China to set up third stock exchange

Australia's Future Fund develops new investment strategy; Aware Super looking for buyers for agribusiness portfolio; China to launch third stock exchange for small and medium businesses, and crackdown on mismanaged private funds; Kotec to hire asset manager for $130 million domestic bond mandate; Malaysia's EPF makes two senior appointments; SGX allows Spac listings; and more

AUSTRALIA

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.