Institutional investors in APAC take cautious steps toward cat bonds

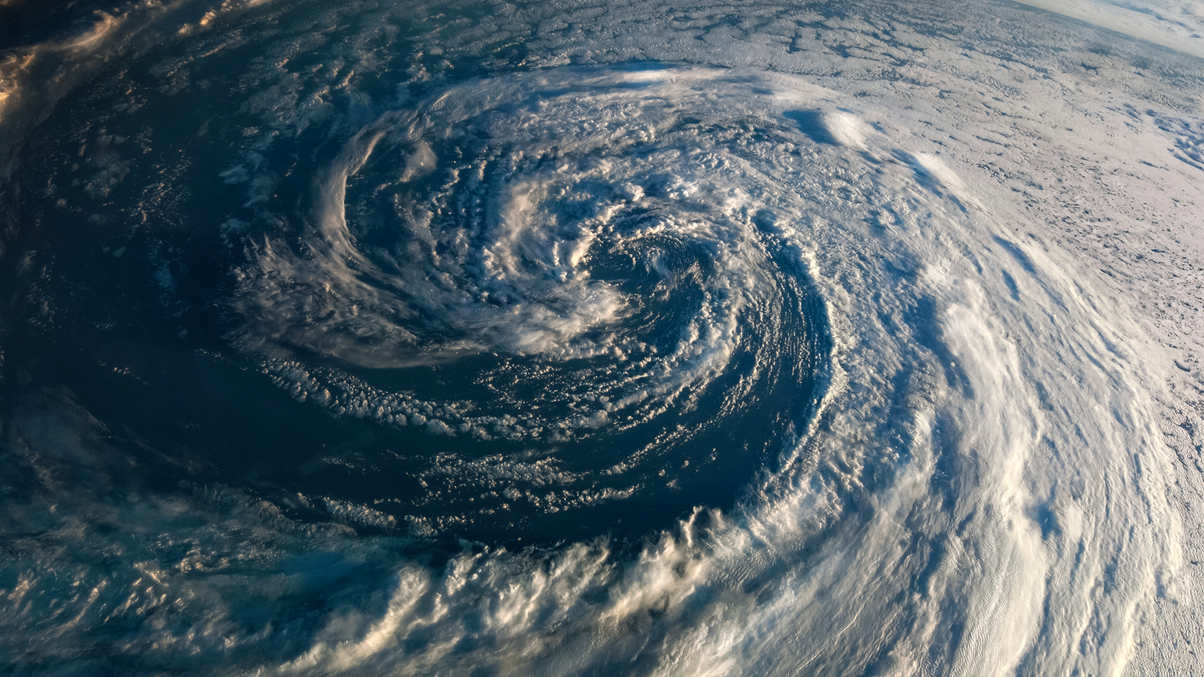

Facing tightening credit spreads and thin equity premiums, asset owners are cautiously embracing ILS for their higher yields and diversification benefits, but allocations remain modest.

Asian institutional investors are turning to insurance-linked securities (ILS), particularly catastrophe bonds, as they search for yield and uncorrelated returns against a backdrop of tightening credit spreads and muted equity risk premiums.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.