How UniSuper, Cbus and Future Fund manage property climate risks

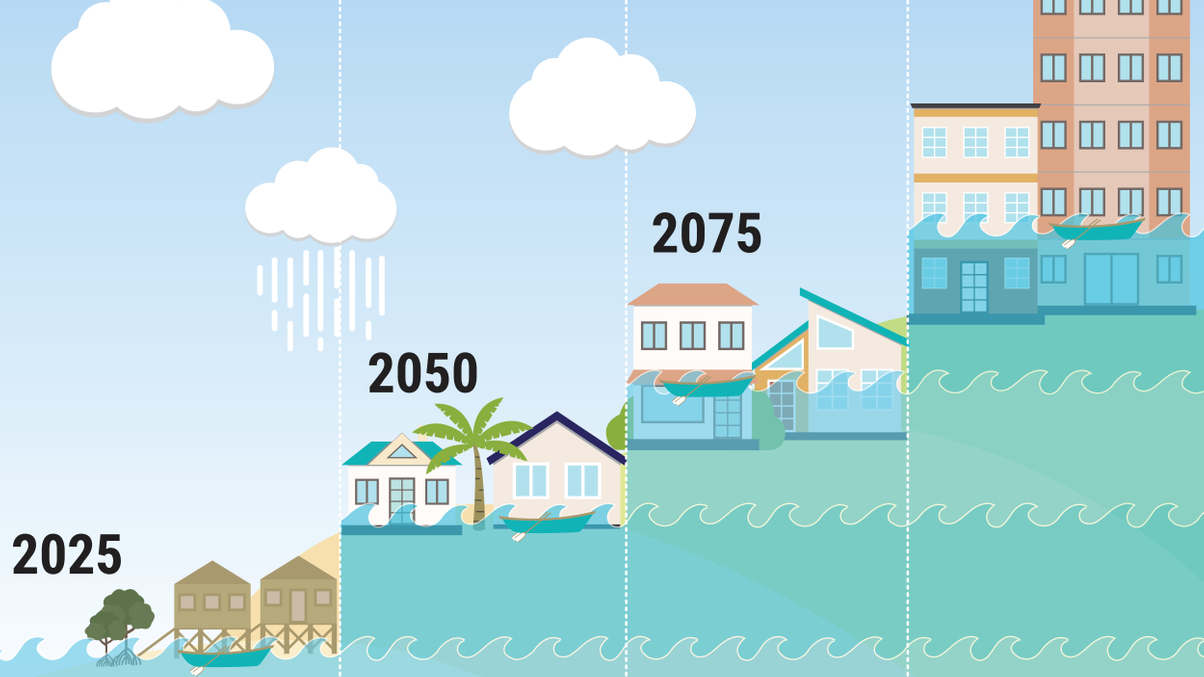

Climate risk could lead real estate values to fall 1% per annum. Some of Australia's leading asset owners and several fund managers have developed measures to mitigate this risk.

Rapidly rising appetite for Australian property among regional and international asset owners could leave the institutions exposed to billions of dollars of lost investment value. However, asset owners such as UniSuper, Future Fund, Cbus, Lendlease and fund managers argue that it's possible to protect returns by combining active investing and pricing in climate risks.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.