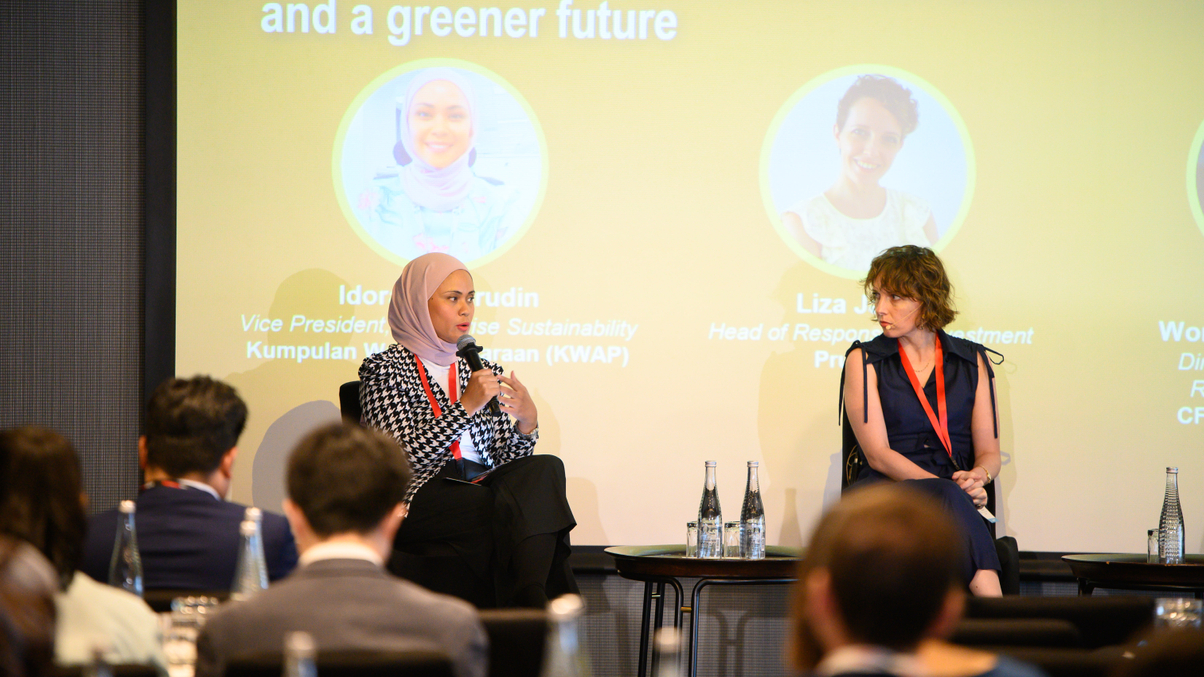

How Prudential Plc, KWAP navigate global sustainability needs and standards

The global life insurer and Malaysian pension fund both shared their approaches to green investments, local market challenges, and combating greenwashing.

Prudential Plc’s climate journey began when it became one of the early implementers of the Task Force on Climate-Related Financial Disclosures recommendations in 2018, according to the firm’s head of responsible investments, Liza Jansen.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.