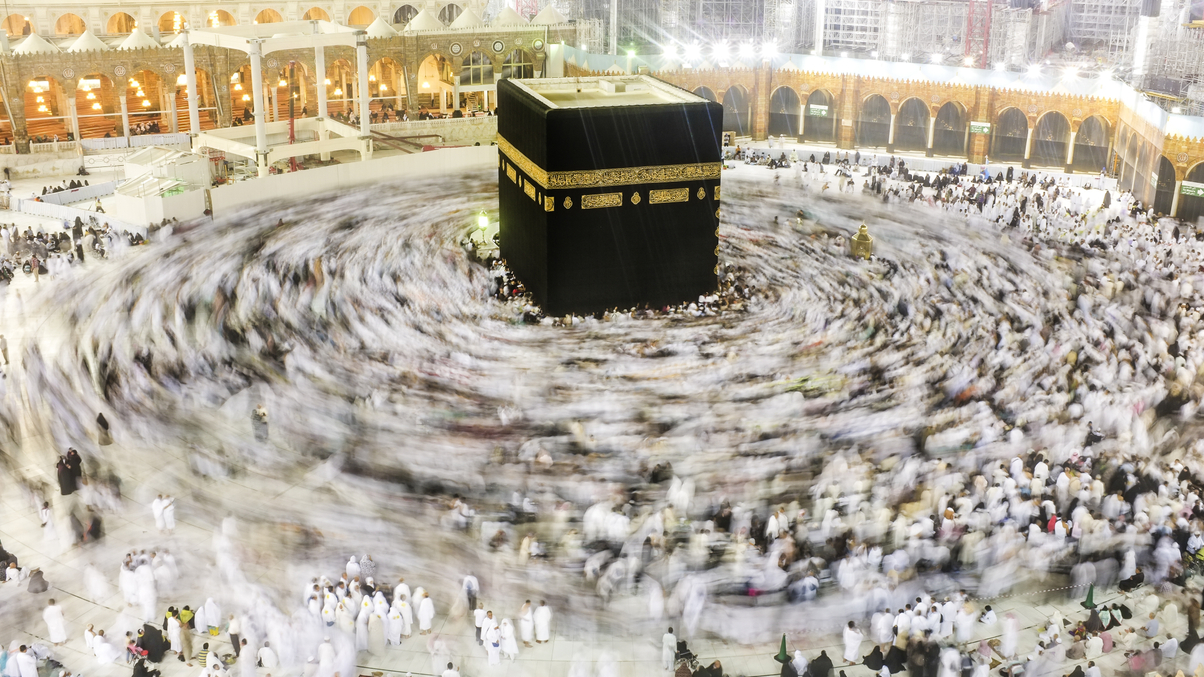

How Indonesia’s hajj pilgrim fund will shift 6% of its assets

Indonesia's two year-old hajj savings fund wants to invest 70% of its assets outside of bank deposits by 2021; it's at 64% today. Its CIO tells AsianInvestor how it plans to do it.

Indonesia’s hajj pilgrims fund has $583 million to invest, and not a lot of time to do it. By December, the fund needs to put 6% of its assets into sukuk, real assets, fund investments or gold.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.