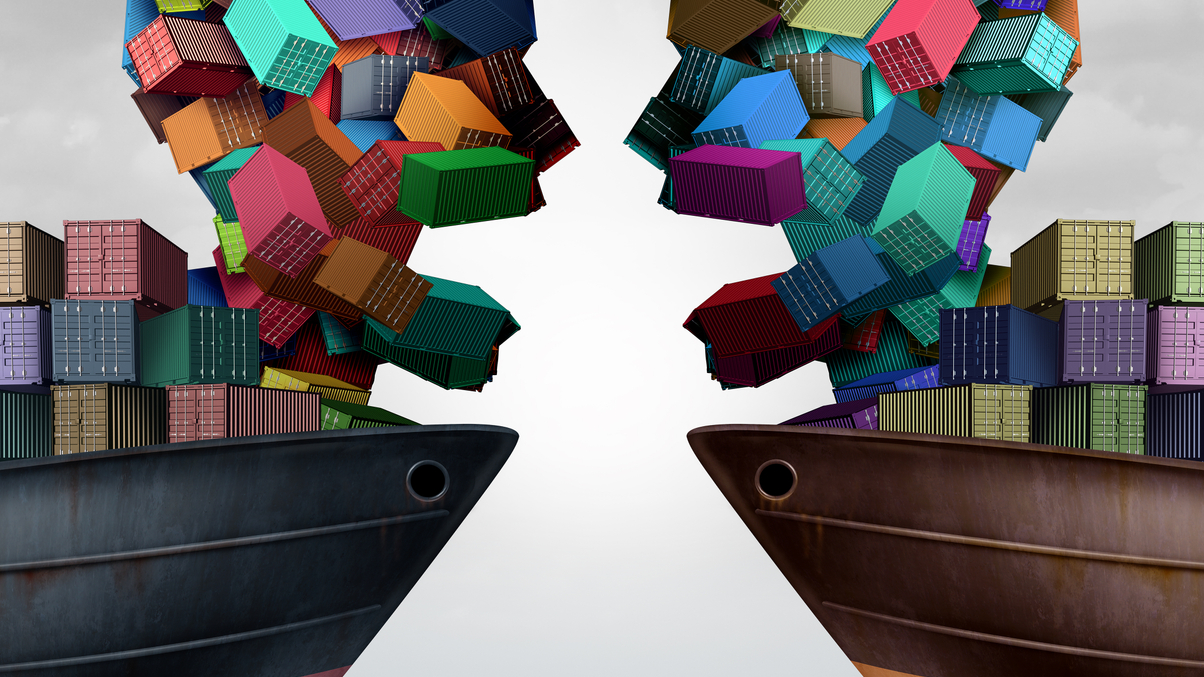

Growing trade frictions threaten Asian equities outlook

US tariffs on aluminium and steel could open the door for broader protectionist measures,

and Asia remains very vulnerable, according to wealth and asset managers.

A trade tariff plan prescribed by US President Donald Trump could potentially lead to a tit-for-tat retaliation by nations around the world, hurting global growth and damaging the prospects for Asian equities, according to market strategies and wealth experts.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.