GLG's new Asian equity team plans long/short strat

Hedge fund veterans join a regional team that aims to replicate GLG’s success in European long/short equity funds.

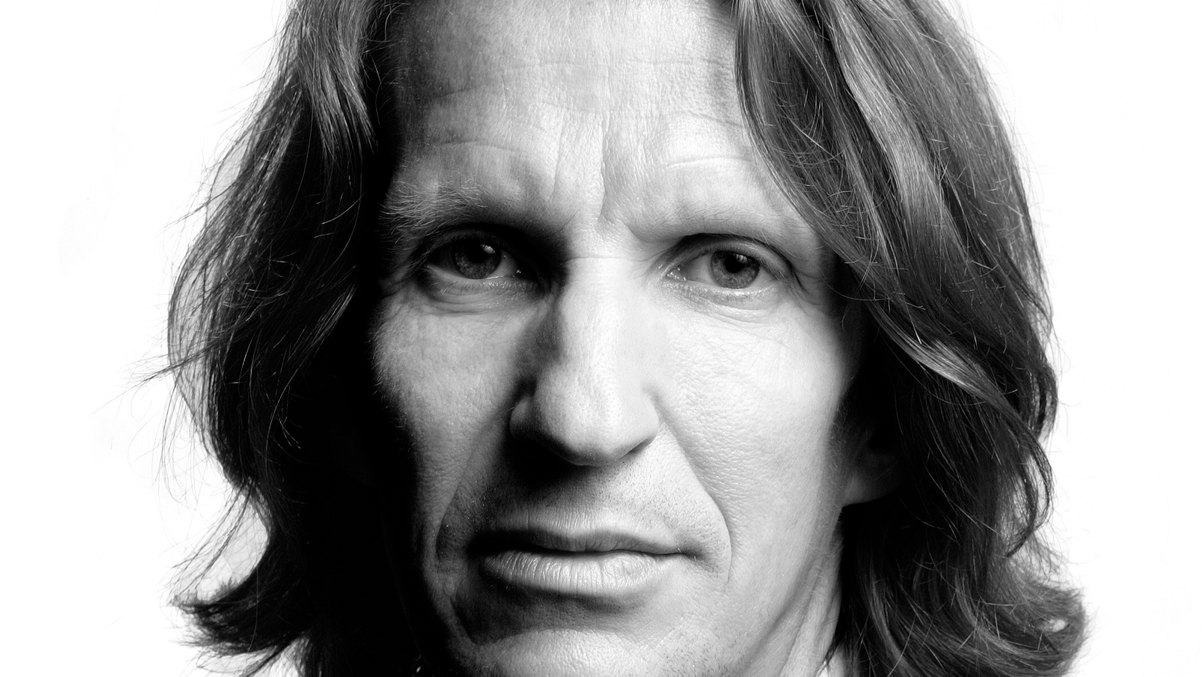

GLG Partners is readying an Asia long/short equity strategy that will be led by David Mercurio, formerly of Singapore's Government Investment Corporation (GIC).

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.