GLG's Lagrange takes top-down view of Europe’s woes

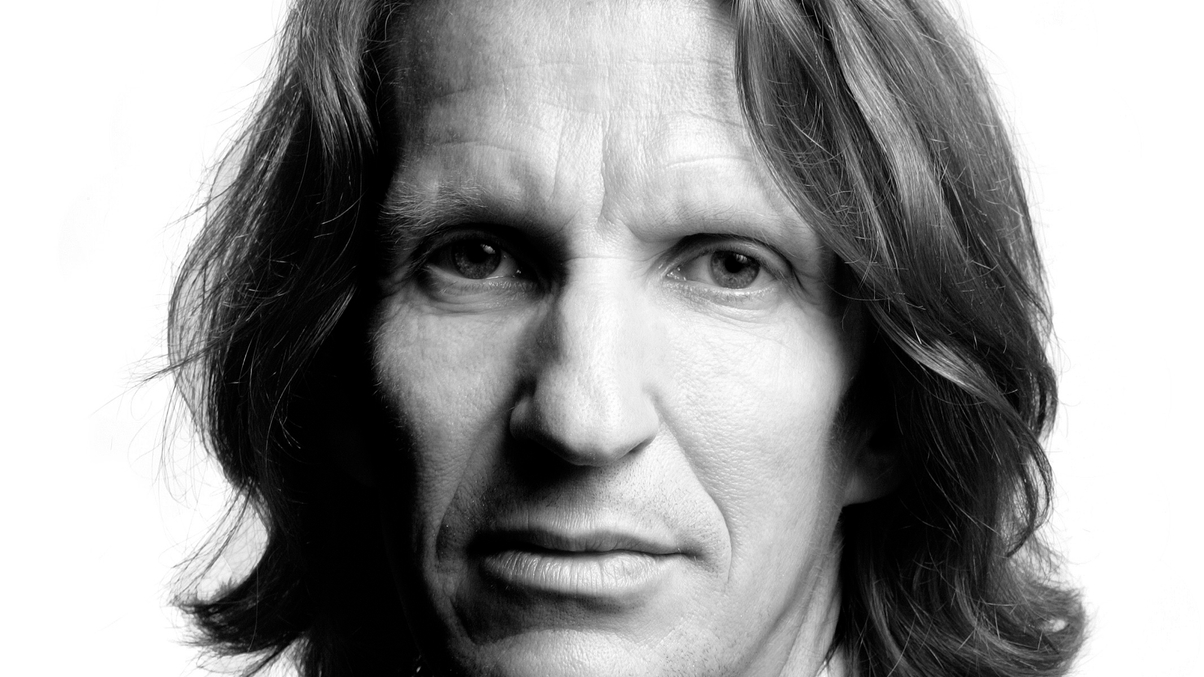

Alternative investment manager Pierre Lagrange explains GLG’s approach to tackling and trading Europe.

Pierre Lagrange, co-founder of GLG and new chairman of Man Asia, was in town briefly last Friday en route to Singapore. He gave AsianInvestor an exclusive that touched on a number of topics (which will be covered more fully in a forthcoming edition of the magazine).

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.