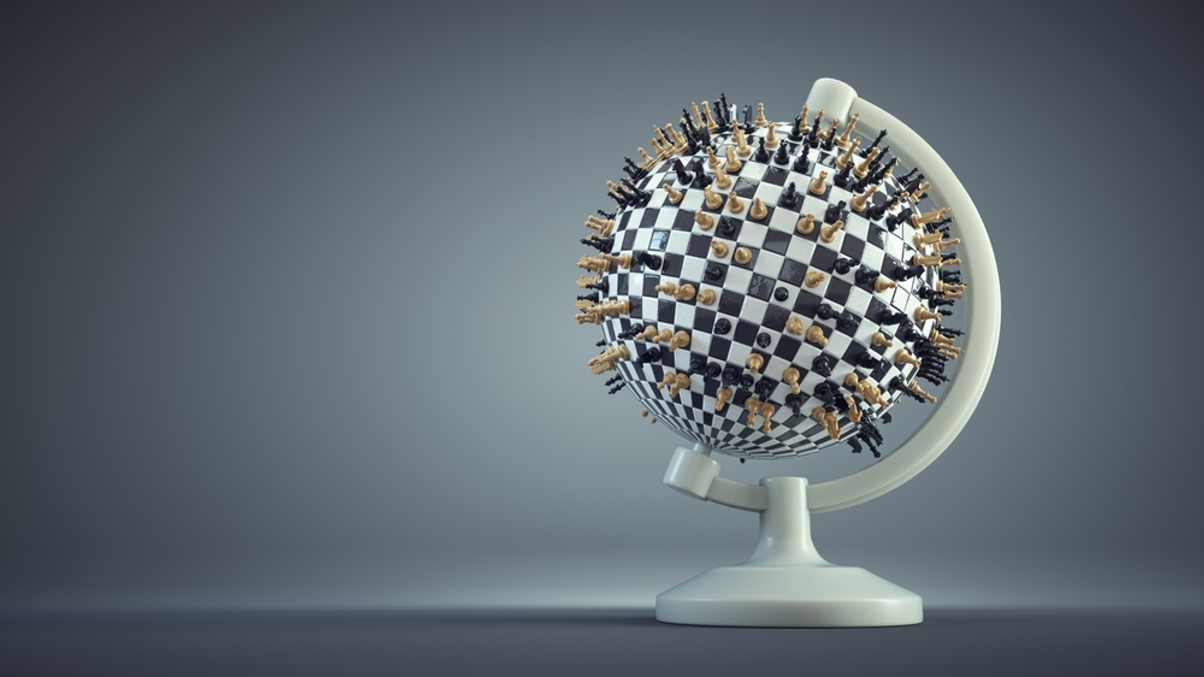

Future Fund warns geopolitical risk now dominant market force

Geopolitical risk is no longer a peripheral concern but a defining feature of the investment landscape, according to the Australian sovereign wealth fund's new position paper.

The era of globalisation-fueled prosperity and relative geopolitical stability is over, according to Australia's A$223 billion ($149 billion) sovereign wealth fund.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.