Foreign investors watch for signs of reform at China party congress

Investors says they are looking for key areas of focus, including the new leadership's composition, capital controls, property and state-owned enterprise reforms.

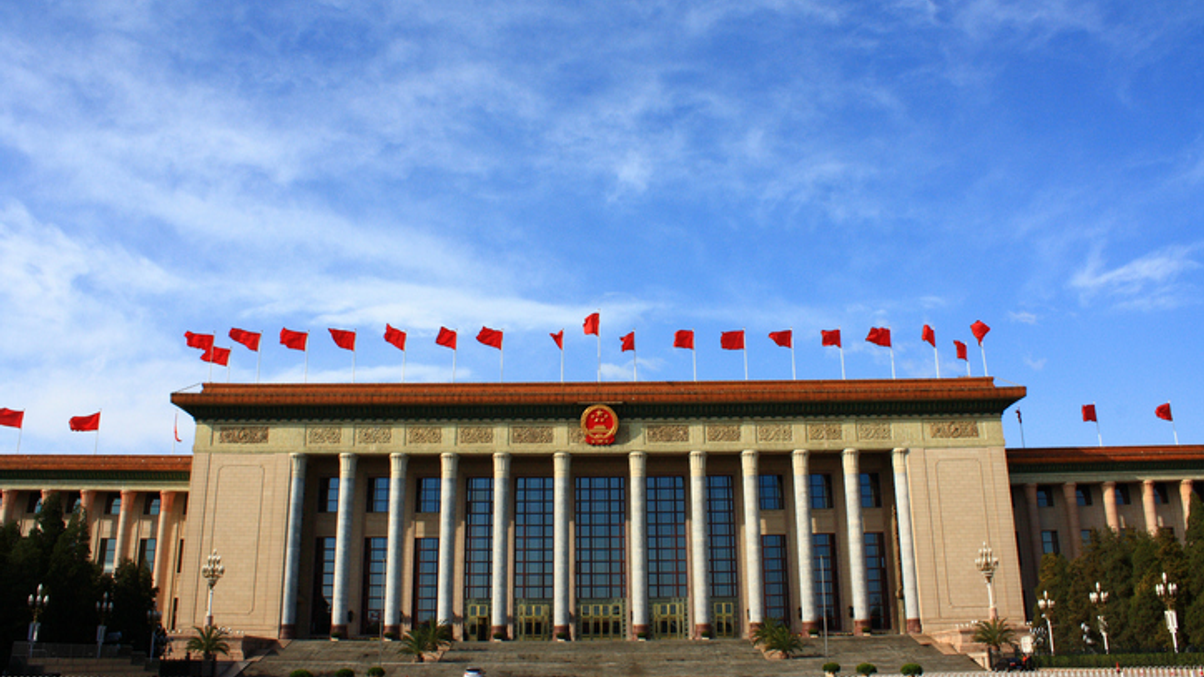

International investors are focused upon indications of China's Communist party leaders commitment to further reforms in the country's National Congress of the Communist Party of China (CPC), which commences today (October 18) in Beijing.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.