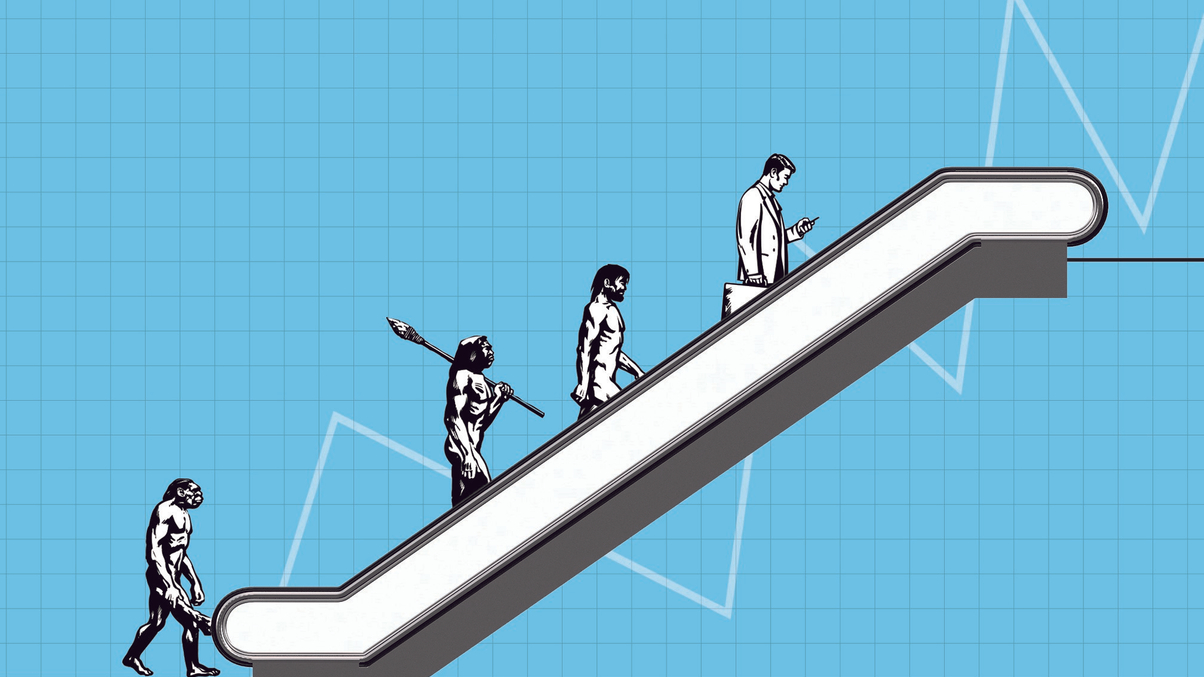

ESG and debt: the next steps for passive investing?

Asset owners could evolve their usage of index funds and ETFs by turning to more environmental, social and governance plus fixed-income vehicles, say experts.

This article was adapted from a feature in AsianInvestor's Spring 2020 edition, which was published in early March, as the coronavirus was spreading across the world.

As the asset owners invest, the manner in which they do so could well change. A key driver is likely to be ESG.

News of record-breaking temperatures and extreme weather conditions is putting pressure on governments, fund managers and asset owners alike. Those that do are less likely to see their investments suffer from onerous regulatory costs or bad news headlines, which means stock valuations are less likely to suffer.

Environmental, social and governance investing has many different investment approaches. Investors can either eliminate companies from an index (an exclusion approach), focus on top performing players (an inclusion approach) or measure players that are likely to improve (an engagement approach).

All, however, depend on the ability to accurately measure ESG performance based on a variety of metrics. And that work can be systemised into a passive index.

It’s proving a popular approach. “Approximately 55% to 60% of the AUM for ESG investing is passive,” estimated Jarrad Linzie, head of index research product development at JP Morgan. His employer has close to $15 billion invested using its ESG indexes.

Japan's Government Pension Investment Fund (GPIF) is a big advocate. The $1.5 trillion pension giant sourced a set of ESG-compliant stock indexes from MSCI, FTSE Russell and S&P Dow Jones Indices during 2017 and 2018 and has allocated billions of dollars to follow them. And in the trial period of its new Index Posting System, which keeps track of an array of indices, the pension fund asked for foreign equity ESG, diversity and environmental bond index suggestions.

Market players think more is likely. “We see ongoing interest in the emphasis on ESG and passive investing, particularly following big mandates from the likes of GPIF,” said Janet Li, wealth business leader for Asia at investment consultant Mercer.

We see ongoing interest in the emphasis on ESG and passive investing, particularly following big mandates from the likes of GPIF

“Asset owners like GPIF or Hong Kong Monetary Authority or Cathay Life or BLF all say they have something in equities and now they need to onboard [ESG] across the entire strategy,” agreed Linzie. “Some are starting at smaller levels but the overarching theme is to make everything ESG.”

Fund houses are taking notice. On January 20, BlackRock, the largest issuer of ETFs, said it was signing up to the Climate Action 100+ initiative, a campaign led by fund houses urging companies to respond to climate change.

FIXED INCOME INTEREST?

Fixed income offers another area for passive investing. But there is less unanimity of opinion about whether it will happen.

Leading asset managers such as BlackRock, SSGA and others say asset owners will adopt passive bond vehicles.

“The fastest growing category of ETFs globally and regionally are fixed income ETFs and clients say: ‘we want to build fixed income and be active in our fixed income approach to manage liquidity,’” said BlackRock’s Geir Espeskog, head of iShares distribution for Asia Pacific at BlackRock. He added that ETFs can give Asian investors easy exposure to bond markets they might know little about.

Of course, increased passive penetration in bonds would greatly benefit leading passive fund houses. But fixed income is undeniably becoming tougher to make money in. The US 10-year Treasury yield dropped under 1% for the first time ever on March 5, while the 10-year German Bund was yielding -0.689% on the same day. As the coronavirus has worsened the 10-year Treasury yield had dropped further to 0.659% on Monday (May 25) while the equivalent Bund had risen a fraction to a still negative yield of -0.488%.

NZ Super believes it makes sense to buy some bonds passively. “I can say very directly, developed equity markets is one [area where passive investing can help], and even developed bond markets. It’s quite hard to beat them via active investing; they are efficient," said David Iverson, head of asset allocation at the sovereign wealth fund.

GPIF is also interested. For the trial phase of its IPS system it specifically asked for information on local and international bond indices that either tracked green bonds or weighed contributing issuers by environmental factors.

Other potential fixed income passive investors include defined benefit ORSO funds in Hong Kong, which are closed and slowly shifting into an asset decumulation phase, as their net cash flows turn negative. Richard Cooney, a senior investment consultant at Willis Towers Watson, said these funds are more likely to invest passively in treasury assets as part of their efforts to manage their assets to liabilities.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.