China’s new ruling elite to decree ‘steady as she goes’

China’s revamped leadership team will likely emphasise stability at the Party Congress next week, but watch out for hints of further state sector reform.

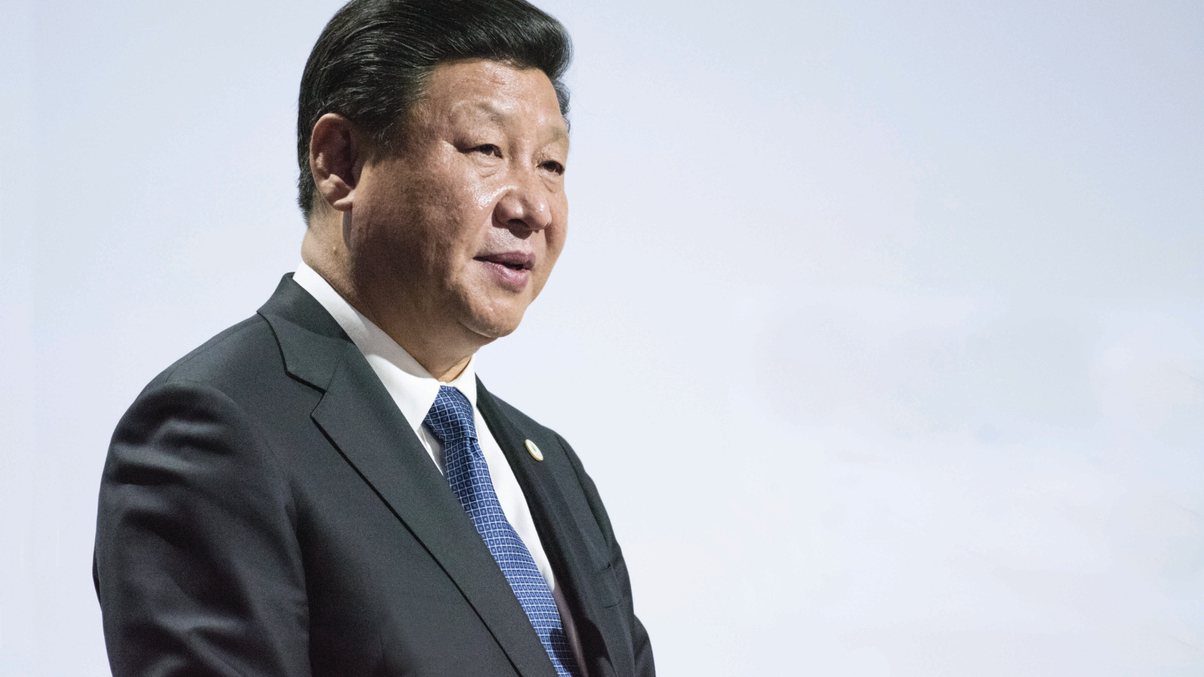

President Xi Jinping looks likely to tighten his grip on power at a key Communist Party gathering next week, a move that should smooth the way for reform of the bloated public sector.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.