China, Japan hedge funds lag as India surges

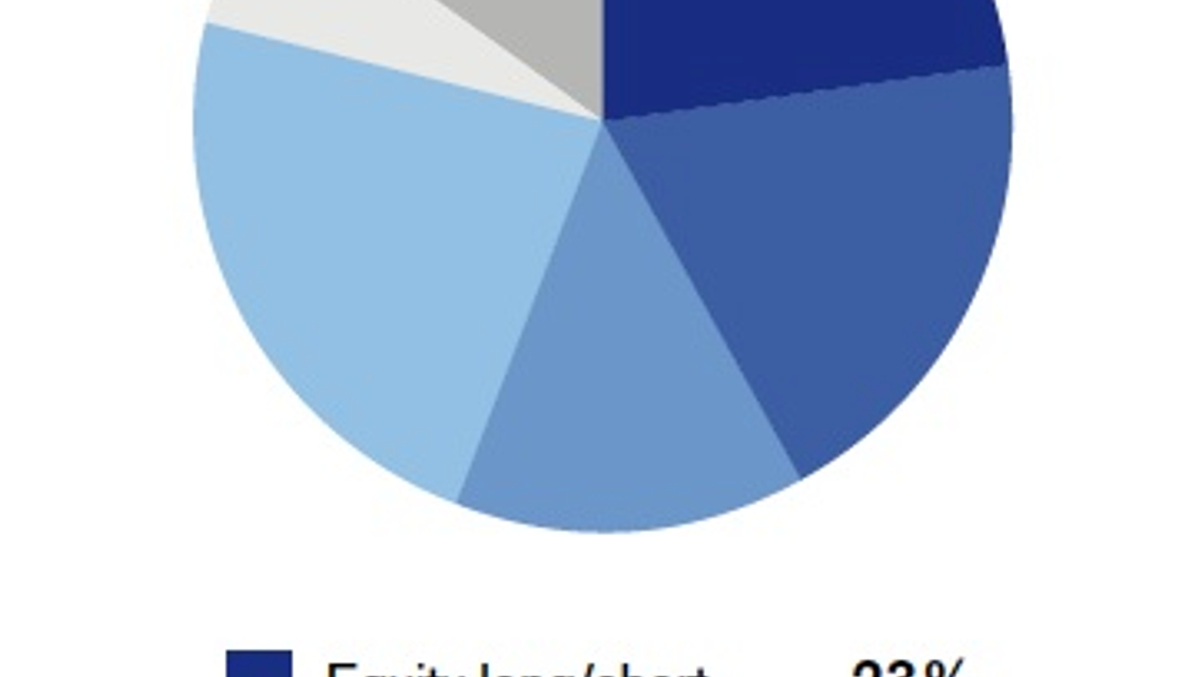

Globally hedge strategies ended the first half with respectable gains, with India funds in particular surging on post-election euphoria. But China and Japan funds have posted falls this year.

Hedge funds globally performed strongly in June on an aggregate basis, adding to respectable first-half returns. That said, China- and Japan-focused strategies posted losses in the year to end-June, while Indian funds surged.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.