China fund-company profits likely to suffer, says Harvest

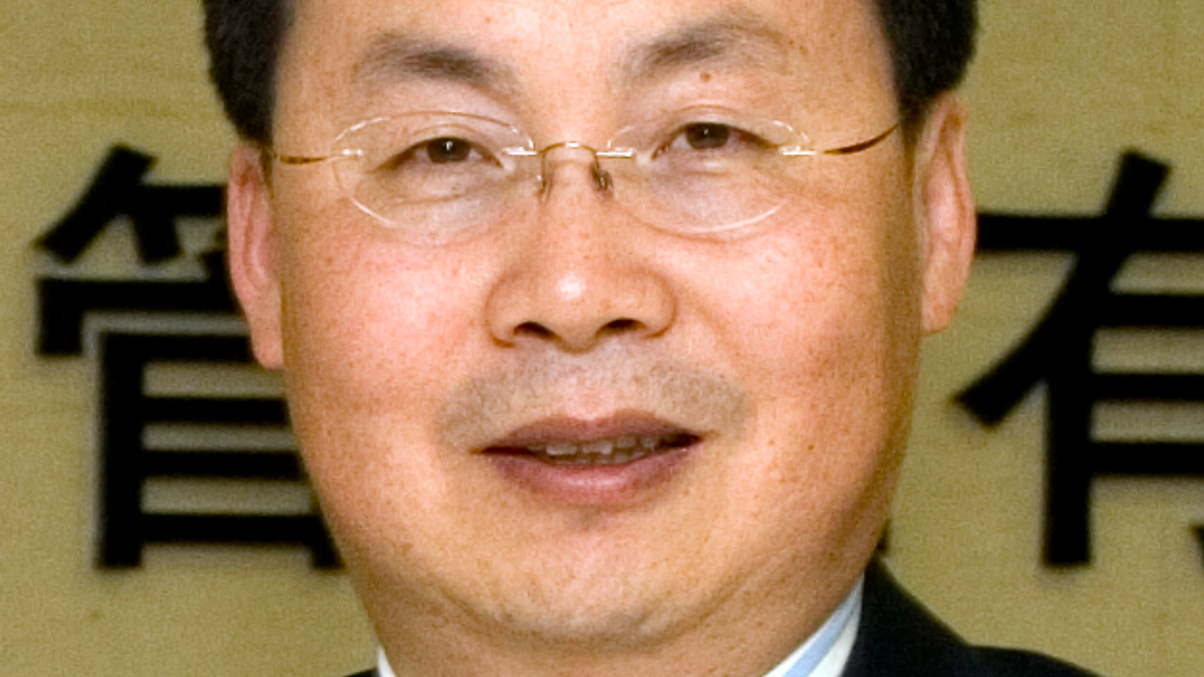

Henry Zhao, CEO at Harvest Fund Management in Beijing, says the industry needs to prepare for consolidation.

Consolidation in China's funds industry is imminent as slower economic growth is certain to erode profits, argues Henry Zhao Xuejun, Beijing-based CEO at Harvest Fund Management, one of China’s oldest fund-management companies

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.