Cathay Life eyes external help with offshore bonds

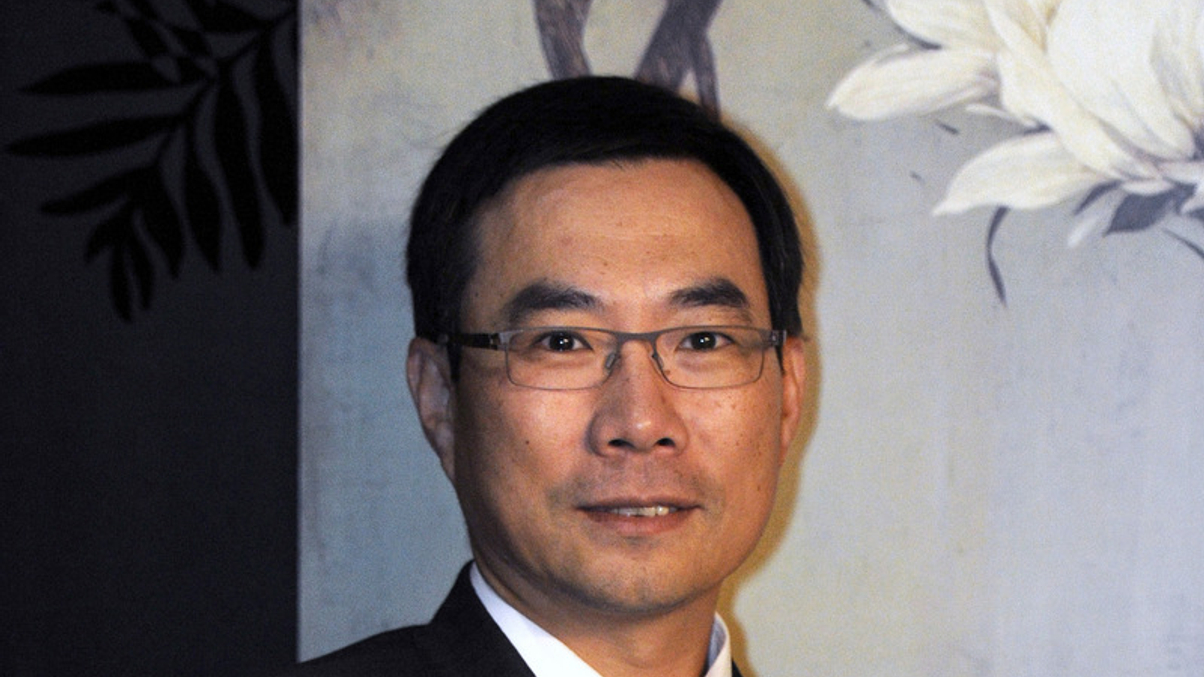

With regulations set to be eased to allow Taiwanese insurers to invest lower down the global bond spectrum, Daniel Teng of Cathay Life says it may capitalise, but will need external help.

Cathay Life Insurance could seek to extend its overseas corporate bond portfolio into the lower end of the investment grade spectrum and even into junk territory, should regulations allow.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.