Barings to develop new Asia bond funds

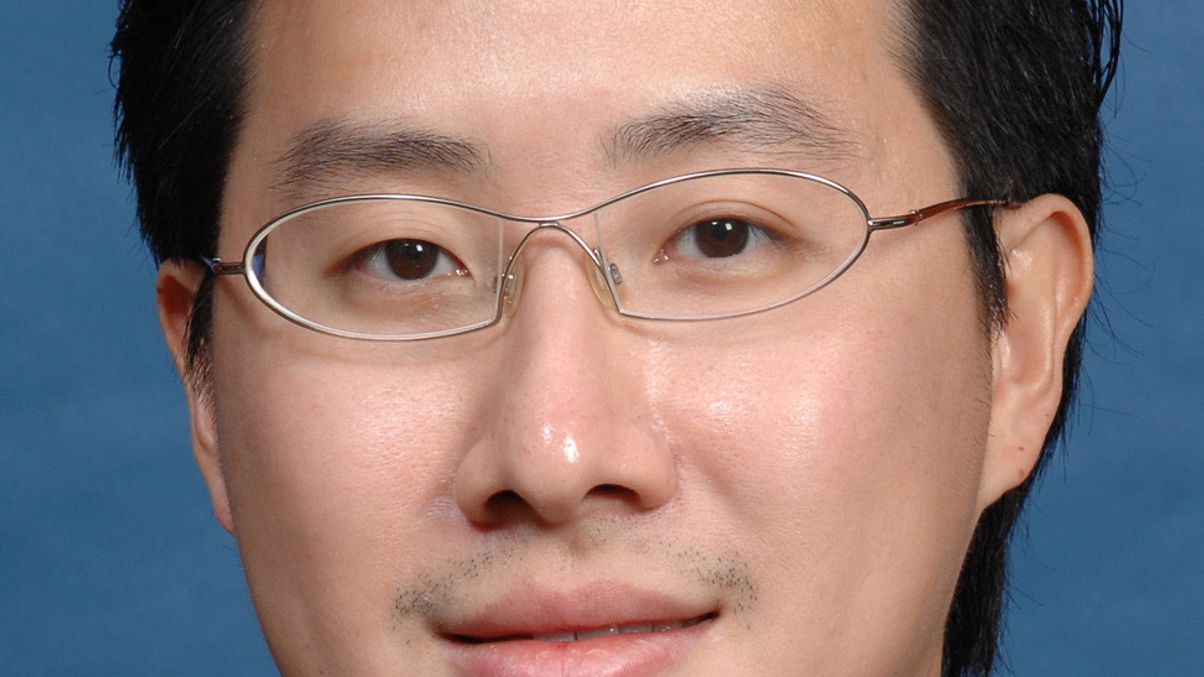

Sean Chang, the firm’s new head of Asian debt investment in Hong Kong, says Baring Asset Management will focus more on its Asian fixed income business.

Baring Asset Management intends to expand its Asia fixed-income business by adding new products and marketing existing ones to new channels, says Sean Chang, head of Asian debt investment in Hong Kong. He joined the firm in May from HSBC Global Asset Management.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.