Aware Super warns of pulling funds from non-green firms

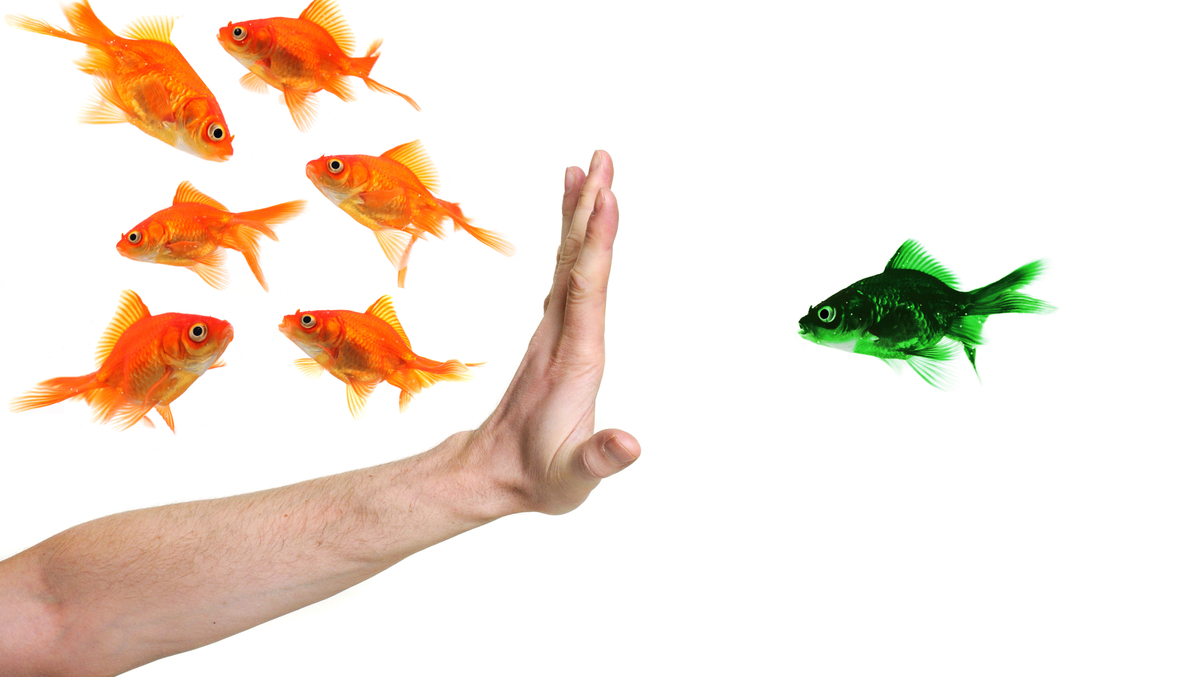

For Australia’s second-largest super fund, it’s a case of get green or get out, but engagement and collaboration is still the preferred solution.

Aware Super has warned that companies that fail to meet climate targets risk divestment from the A$150 billion ($109.69 billion) fund, but Australia’s second-largest superannuation fund would only strip companies of capital as a last resort – preferring instead to “support them” towards sustainability.

Nice choice! This is premium AsianInvestor content.

Subscribers can sign in for full unlimited access.

New user? Sign up for a one-time 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.