Asia ex-Japan hedge funds outperform peers

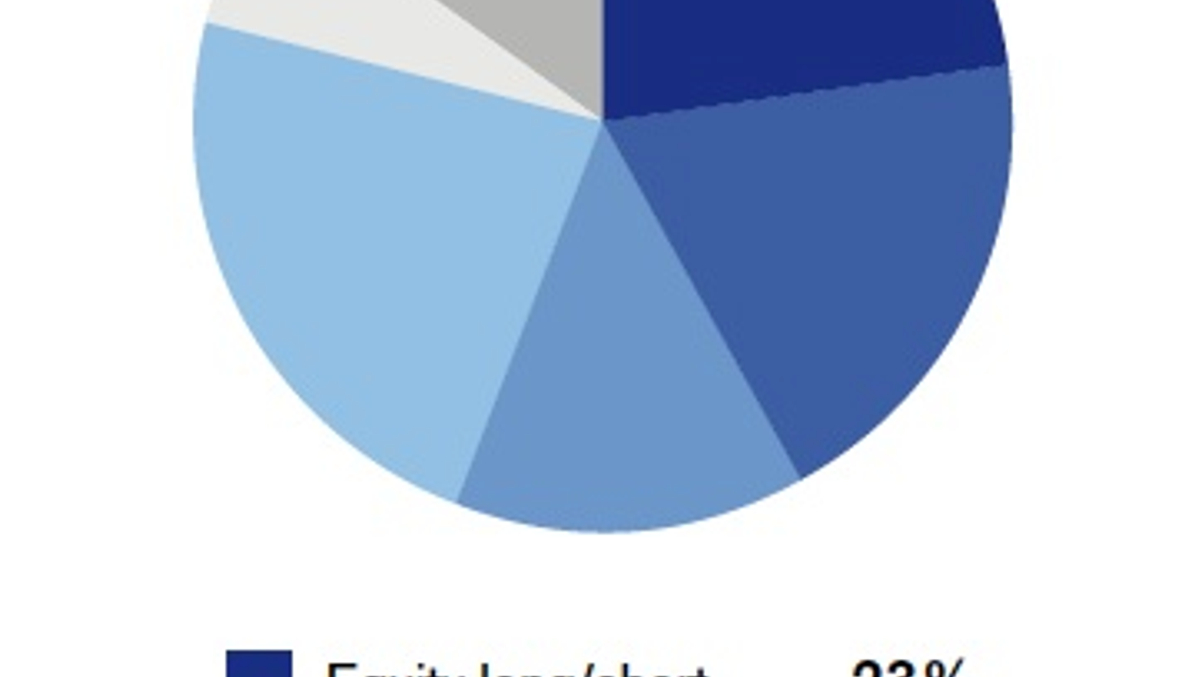

They have risen 7.26% to date this year, stirring expectations of stronger inflows, while long/short equity funds lead capital-raising, find two reports.

Asia ex-Japan hedge funds are outperforming global peers to date this year having risen 7.26%, according to the latest Eurekahedge report, stirring expectations of stronger investor inflows.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.