China arrest puts heat on private funds

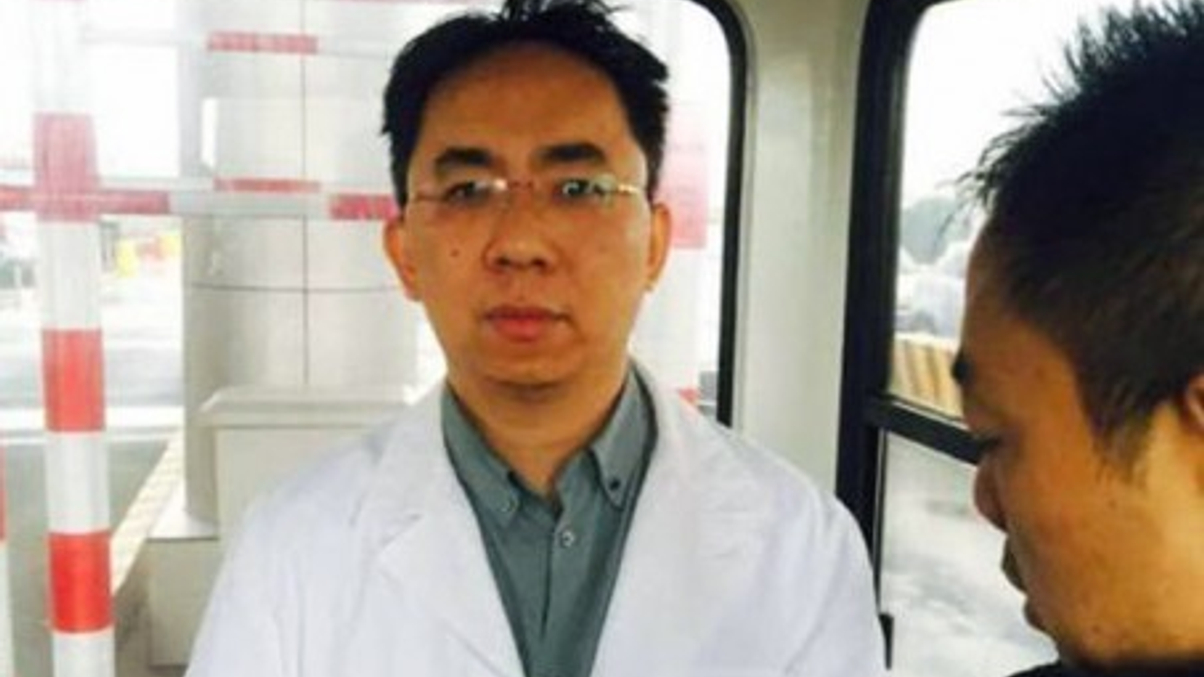

The detainment of the boss of Shanghai’s Zexi Investment – the first such case for a private securities manager – may herald more regulatory focus on this part of the industry.

The arrest of the founder and general manager of Zexi Investment, a Shanghai-based private securities firm, has attracted unwanted attention to China's fast-growing private fund industry.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.