Offshore groups most likely to buy Colonial First State

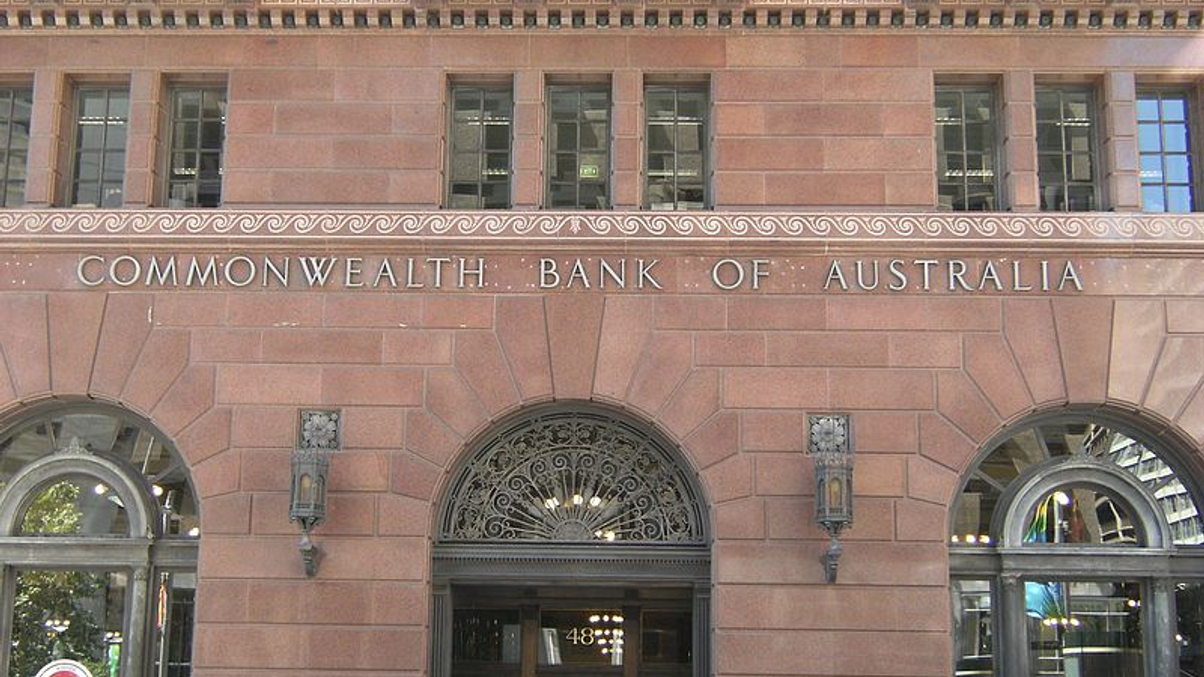

Commonwealth Bank's plan to dispose of Colonial First State is part of an industry consolidation that means any buyer would almost certainly come from outside Australia.

Commonwealth Bank of Australia's (CBA) plan to either sell or list its asset management division Colonial First State is likely to attract the attention of ambitious offshore asset managers wanting to bolster their international operations, say industry executives.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.