JP Morgan AM adds in sales, loses one to Invesco

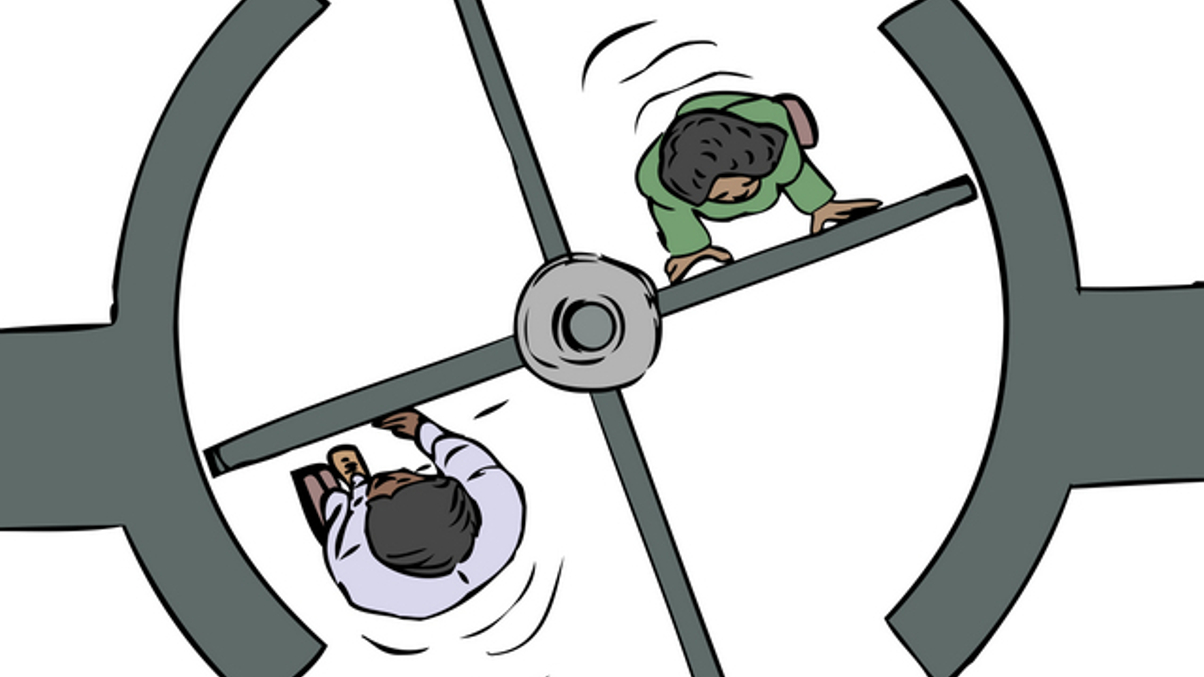

JP Morgan Asset Management has expanded its Southeast Asia coverage, but has seen at least two individuals leave in Hong Kong, one for a rival US fund house.

JP Morgan Asset Management has made several appointments across its institutional and intermediary teams in Asia as part of a reorganisation of its client coverage in Southeast Asia, AsianInvestor can reveal. The firm has also seen at least two recent departures from its sales teams.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.