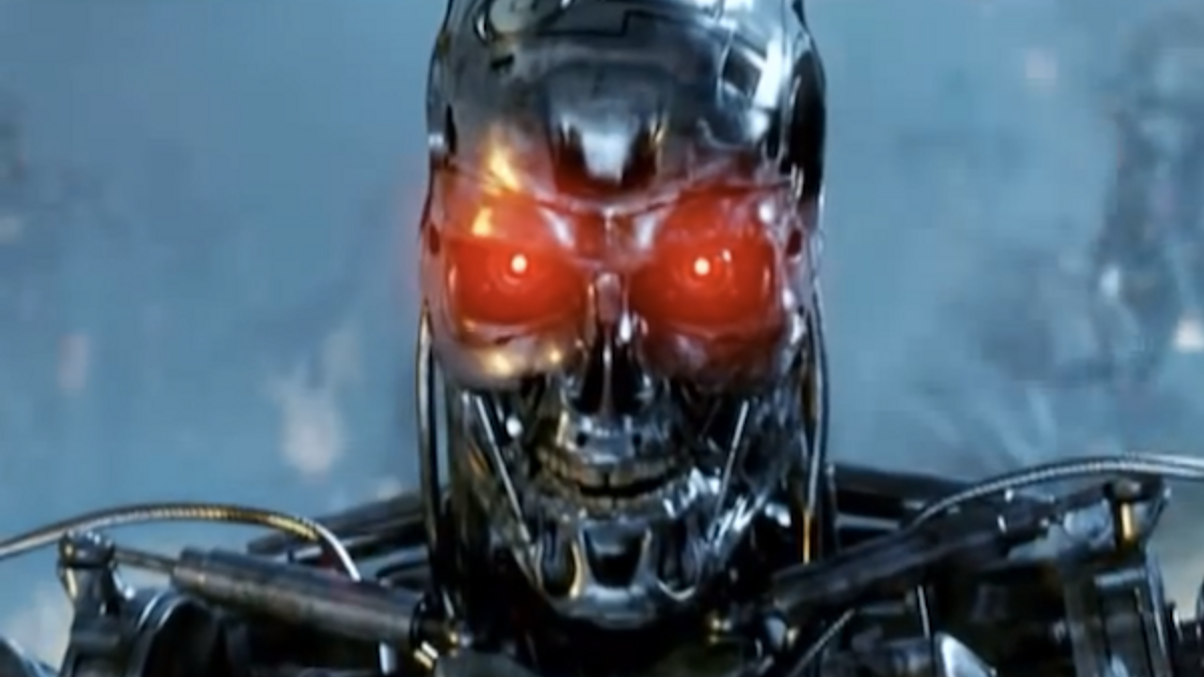

Will technology render many asset management activities obsolete?

We have identified the five most crucial challenges facing the asset management industry. Today we address the fourth issue: the extent to which technology will usurp humans.

The asset management industry in Asia has undergone big changes since AsianInvestor started in 2000. Having served as the title's founding editor and, more recently, as editorial director at Haymarket Financial Media, I’ve enjoyed a front-row seat. As my final contribution for AsianInvestor, I have come up with a list of what I consider the top five issues facing the industry.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.