Amundi to move into Asia's competitive ETF marketplace

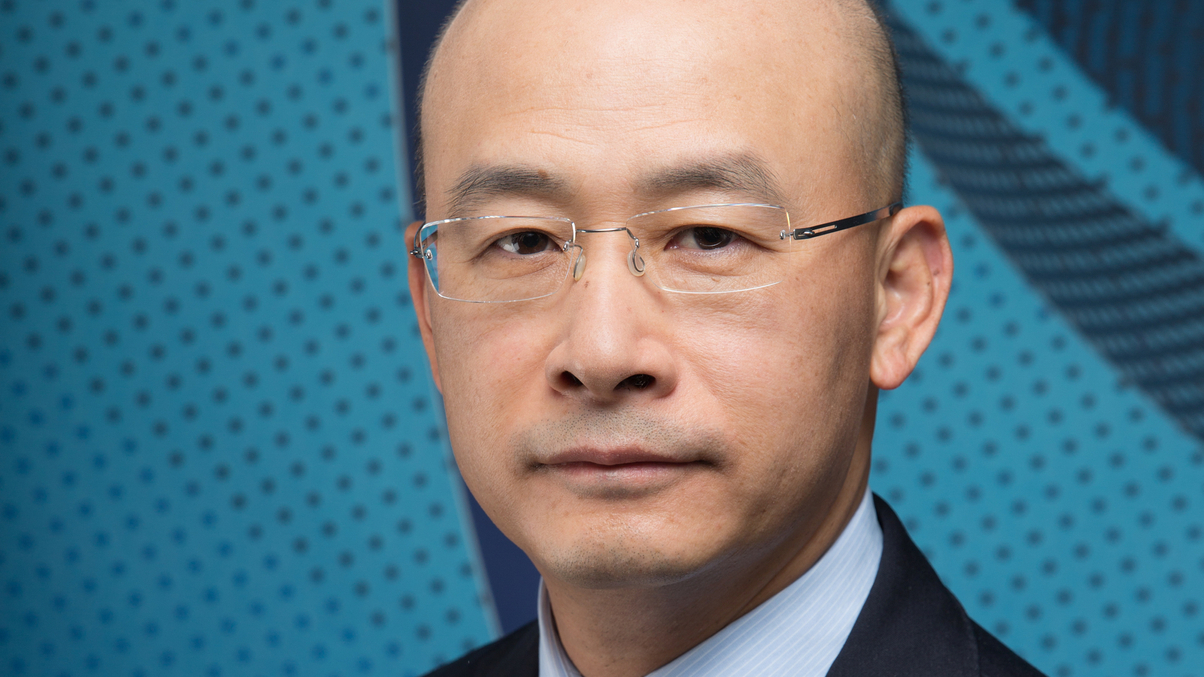

The French asset manager will soon make its debut in Asia's ETF market, which its North Asia CEO acknowledges will be a challenge given rising numbers of providers in the popular passive sector.

Amundi is to move into the ETF market in Asia for the first time and is looking for a senior business development executive to spearhead sales.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.