Central banker named new CIO at KIC

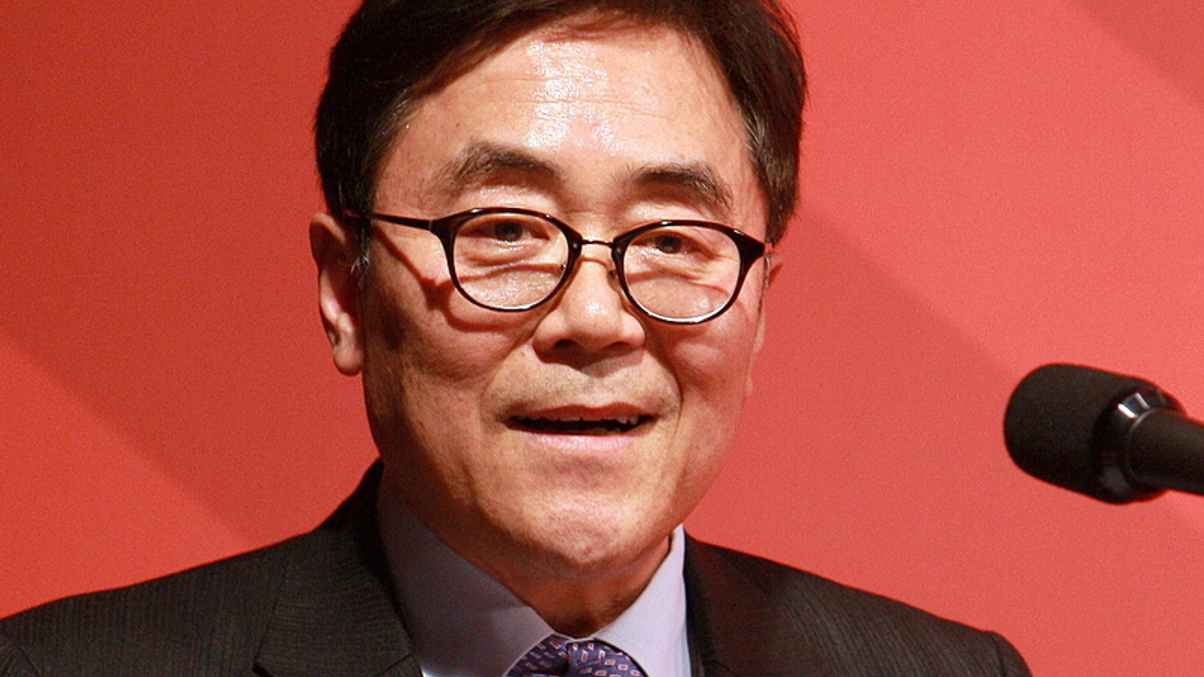

Choo Heung-Sik has made the jump from head of reserve management at the Bank of Korea to overseeing investments at the country's sovereign wealth fund.

Korea’s $74 billion sovereign wealth fund has named Choo Heung-Sik as its fourth chief investment officer to replace Lee Dong-ik, who resigned in January.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.