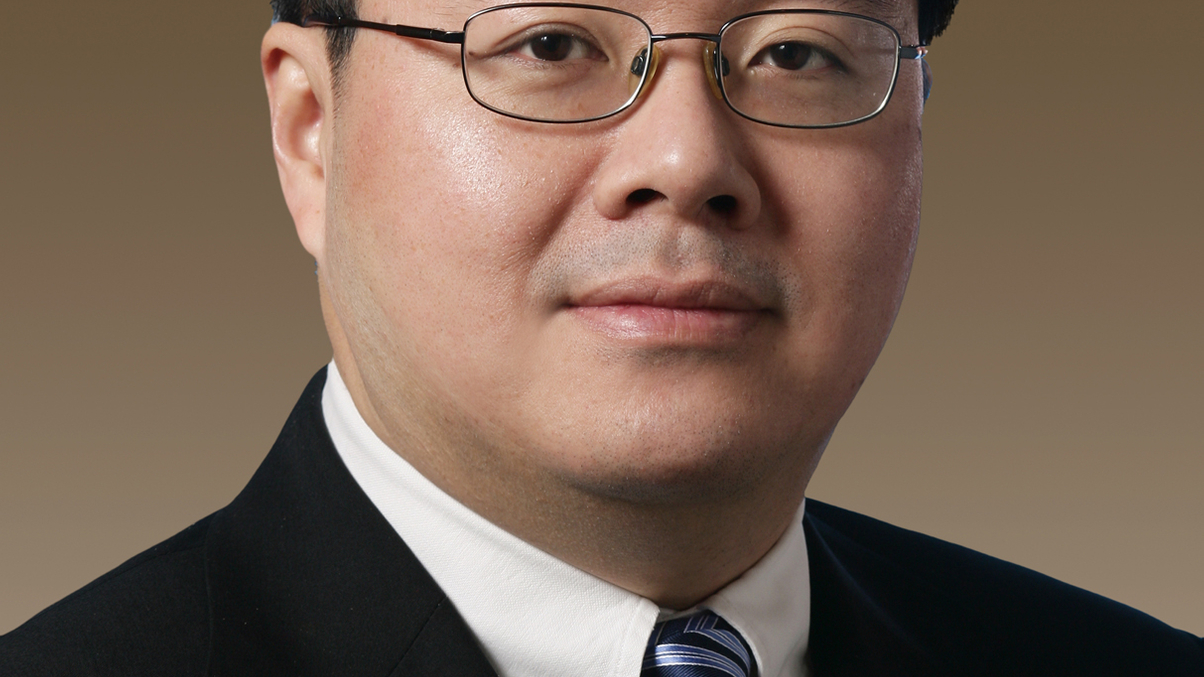

Temasek hires key Citic executive Wu as head of China

Temasek's move to appoint Wu Yibing will help further Singapore sovereign’s push into hi-tech and energy investments on the mainland.

Temasek Holdings is tapping key Citic executive Wu Yibing as head of China, signifying the Singapore sovereign wealth fund’s move to further cement investment ties in the mainland, where it been particularly active in the fast-growing areas of hi-tech and energy.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.