EPF adds $1.3bn in global RE, bonds, equities

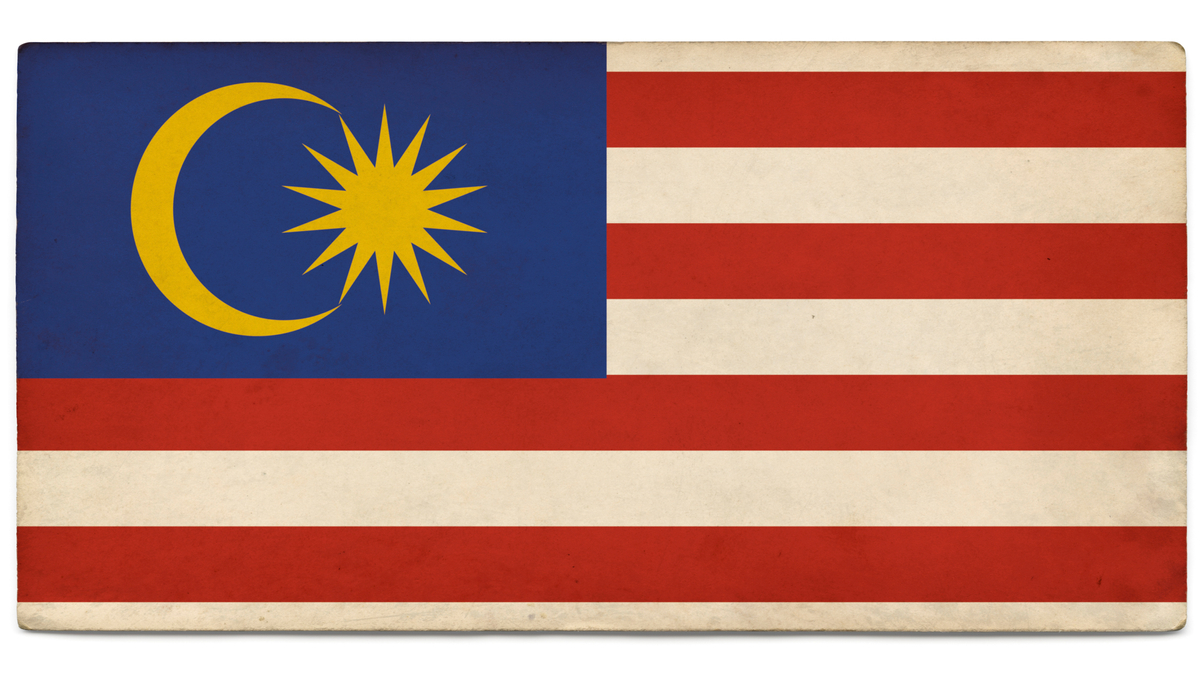

Malaysia’s $177 billion state pension fund continues its drive to diversify more into foreign investments, as its assets maintain their rapid growth.

Malaysia’s Employees Provident Fund (EPF) invested $1.3 billion in global real estate, bonds and equities in the first quarter of 2013, raising its total overseas allocation to 17.55%, from roughly 14% nearly a year ago.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.